Most day traders don’t lose because their strategy is bad.

They lose because they’re looking at the right idea on the wrong time frame.

I’ve seen this pattern repeat for years. A trader spots a clean breakout on the 1-minute chart, enters aggressively, and gets stopped out, only to watch price run perfectly in their original direction ten minutes later. Another trader waits for confirmation on the 15-minute chart, enters “safely,” and gives back half the move because the execution was too slow.

Both traders blame psychology. Or the market. Or “bad luck.”

In reality, they made a time frame mismatch error, one of the most under-discussed failure points in day trading.

This article isn’t going to tell you that “lower time frames are noisy” or that “higher time frames are more reliable.” You already know that. Instead, we’ll break down how professional day traders actually use multiple time frames, why certain combinations work, when they fail, and how to align time frames with your execution style, risk tolerance, and capital base.

This is built from trading experience, performance reviews, and research, not chart clichés.

What Research Actually Says About Time Frames (And What Traders Miss)

Academic and institutional research rarely talks about “5-minute vs 15-minute charts.” Instead, it studies information flow, volatility clustering, and execution timing, which is far more useful if you know how to translate it.

A few findings worth paying attention to:

According to BIS (Bank for International Settlements) research on intraday liquidity, prices in FX and index futures don’t move uniformly during the session. They alter at specific periods, though. There is normally a lot of volatility at the opening of a session, when macroeconomic data is released, and when institutional orders come in.

The CFTC and SSRN have looked at traders who trade a lot and for short periods of time. They learned that signals happen more often in shorter time frames, but so do mistakes, especially when you think about slippage and execution costs.

The NBER’s study shows that traders who align their decision horizons (analysis vs. execution) trade less and experience drawdowns that are less volatile.

For traders, this means in simple terms:

Markets don’t reward speed alone.

They reward time frame alignment, matching where you see opportunity with where you execute risk.

Most retail day traders collapse all decisions into a single chart. Professionals don’t.

The Core Question Isn’t “Which Time Frame?” — It’s “For What Purpose?”

Here’s the mental shift that changes everything:

Time frames are tools, not identities.

You don’t “trade the 5-minute chart.”

You use different time frames for context, structure, timing, and execution.

Let’s break this into a practical framework used by consistently profitable day traders.

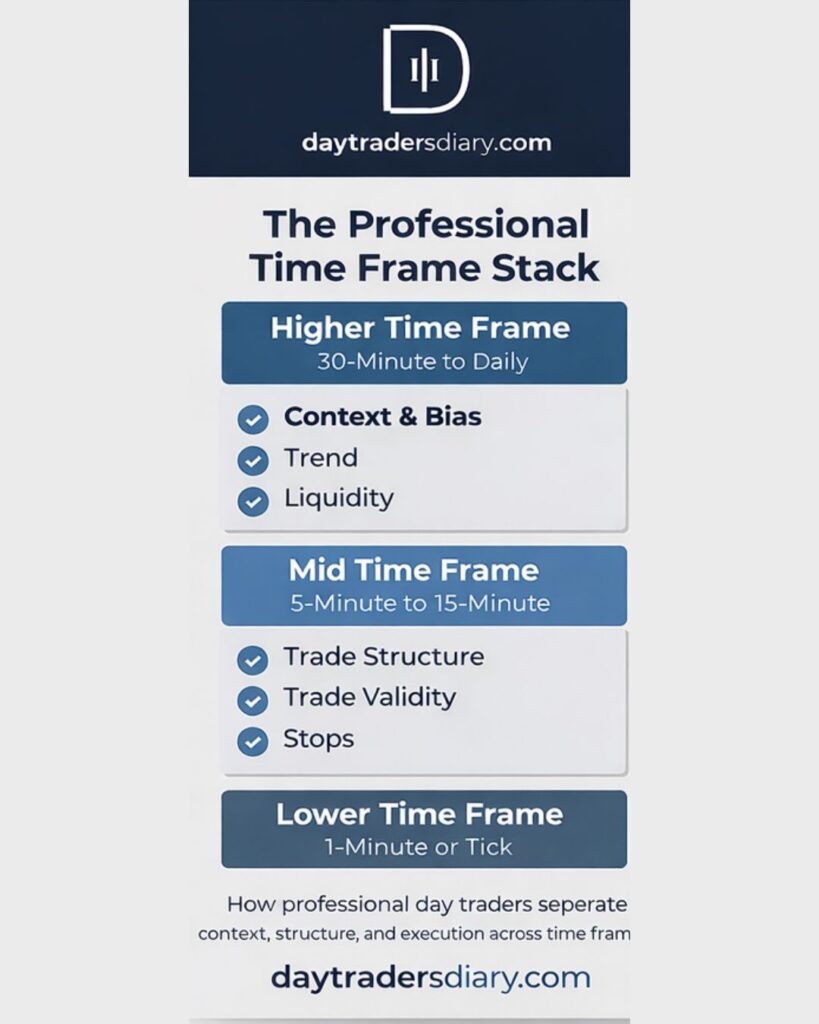

The Professional Time Frame Stack (How It’s Actually Used)

1. Higher Time Frame (30-Minute to Daily): Context & Bias

This is where day traders frame the battlefield.

The job of the higher time frame is not to generate entries. It answers three critical questions:

- Is the market trending, ranging, or transitioning?

- Where is higher-time-frame liquidity likely sitting?

- Am I trading with momentum or fading it?

Most professional day traders anchor bias on the 30-minute or 1-hour chart, not the daily. The daily chart is useful, but it’s often too slow to reflect intraday regime shifts, especially in indices and FX.

This is where traders often misread the market. They see a bullish daily candle and assume “longs only,” then spend the entire London or New York session getting chopped because intraday structure is rotating.

Context does not mean direction certainty.

It means directional pressure and invalidation levels.

If this part is unclear, it’s usually because the trader hasn’t internalised market structure, something we’ve covered in depth in related DayTradersDiary.com articles on intraday structure and session bias.

2. Mid Time Frame (5-Minute to 15-Minute): Trade Structure

This is the time frame for making a decision.

Professional day traders set the mid time window as:

Entry zones (not exact entries)

Stop placement rationale

Trade validity (continuation vs. mean reversion)

The 5-minute chart is the most important for active day traders because it strikes a good balance between clear signals and relevant execution. Traders who take fewer, more selective deals or trade slower items generally use the 15-minute chart.

Most traders don’t see this important point:

If your stop is based on the 5-minute chart, your trade reasoning must also derive from the 5-minute chart.

A 1-minute entry and a 15-minute halt are hardly “precision.” It’s not consistent in structure.

This is where many traders unintentionally increase risk without realising it, a topic closely tied to position sizing errors discussed elsewhere on DayTradersDiary.com.

3. Lower Time Frame (1-Minute or Tick): Execution Only

It’s not a good idea to make decisions on lower time frames. They are for making things run more smoothly.

When professional traders need to answer small questions, they go down to the 1-minute chart:

Is momentum speeding up or slowing down at my level?

Is it possible to make the stop size smaller without breaking the structure?

Is liquidity coming in or going out?

If you’re thinking on the 1-minute chart, you’re already late.

This distinction matters because many traders confuse “more detail” with “more accuracy.” In reality, lower time frames amplify emotional noise. They’re useful only when the higher-time-frame logic is already locked in.

Matching Time Frames to Trading Style (Not Ego)

Let’s apply this with real-world logic.

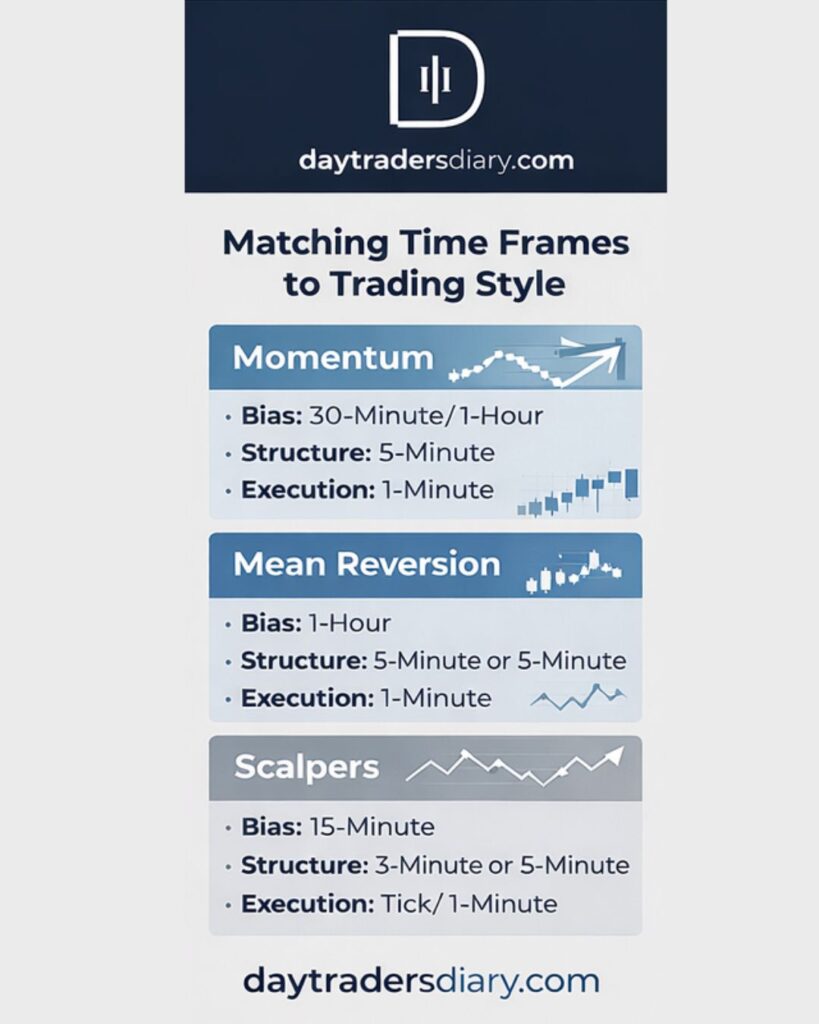

Momentum Day Traders

If you trade session breakouts, news reactions, or trend continuation:

- Bias: 30-minute / 1-hour

- Structure: 5-minute

- Execution: 1-minute

Momentum traders fail when they over-filter entries on higher time frames and miss the expansion phase.

Mean Reversion / Fade Traders

If you fade extremes or trade range reversion:

- Bias: 1-hour

- Structure: 5-minute or 15-minute

- Execution: 1-minute

Mean reversion fails when traders enter too early on lower time frames without waiting for exhaustion in higher time frames.

Scalping is not “quick clicking.” It can be done over and over again in a set range of volatility.

Bias: 15 minutes

Structure: 3 or 5 minutes

Execution: Check / 1 minute

Scalpers (Real Intraday Scalping)

Most scalpers fail because they focus on size instead of accuracy and don’t think about how much it costs to make a trade.

When Time Frames Don’t Work Anymore (And Traders Freak Out)

There are some conditions that cause every combination of time frames to break:

Low-liquidity sessions mess up lower time frames.

Mid-time-frame arrangement is broken by big news stories

Signals get compressed when sessions overlap.

Traders that know what they’re doing don’t make trades during these times. They change or step aside.

This is why many professionals reduce size or skip trades entirely during regime shifts, instead of blaming discipline after the fact.

Risk & Execution: Where Time Frame Errors Become Expensive

Time frames directly define risk per trade, whether you realise it or not.

Your stop distance, position size, and expectancy are all time-frame dependent.

This is where most traders miscalculate risk, guessing lot size instead of calculating it. Using a Position Size Calculator removes this guesswork and forces logical consistency between your stop (defined by the time frame) and your account risk.

If your time frame changes, your position size must change with it. Anything else is disguised gambling.

Time Frame Performance for Journaling (This Is Where Edge Actually Forms)

Most trade journals keep account of inflows and exits. Few people keep track of how well their time is being used.

Traders who do well keep track of items like:

What time frame caused the original bias?

Which chart showed the stop?

Did executing on a smaller time frame make R:R better or worse?

What happened with the trade in relation to the session time?

Using a structured Trade Journal Template allows you to isolate which time frame combinations actually produce edge, not which ones feel comfortable.

This is how traders move from random profitability to repeatable performance.

Scaling Beyond Personal Capital (The Ceiling Problem)

Here’s the uncomfortable truth:

Even with a solid edge, time-frame mastery alone doesn’t solve capital constraints.

Many serious day traders eventually realise that consistent execution + strict risk control hits a ceiling when trading personal funds. That’s why evaluation programs exist, not as shortcuts, but as capital multipliers for disciplined traders.

Programs like The5ers evaluation are designed around intraday risk rules that reward consistency, not aggression. Traders who already understand time-frame alignment adapt faster because their execution is structured, not impulsive.

If your strategy already works on small size, scaling through an evaluation account becomes a logical progression, not a gamble.

FAQs: What Traders Still Ask About Day Trading Time Frames

Do professional day traders use only one time frame?

No. They use multiple time frames with defined roles. One for bias, one for structure, and one for execution.

Is the 1-minute chart bad for day trading?

It’s bad for decision-making, not execution. Used correctly, it improves entries. Used incorrectly, it destroys discipline.

What’s the best time frame for beginners?

There isn’t one. But novices normally do better when they use structure on the 5-minute chart and don’t do too much on lesser time frames.

Should time periods alter depending on the market?

Yes. Volatility regimes are more important than what you like.

Final Thought: One Challenge You Can Do

Do this for the next 20 trades:

Set bias on a greater time frame

Set stops on a mid-range time period

Use the smaller time frame exclusively to do things

Write down whether executing on a reduced time period helped or hurt the trade.

You don’t need a new strategy.

You need time frame discipline.

As a next read, revisit the DayTradersDiary.com article on best trading strategies for day traders, it ties directly into everything you’ve just learned here.

Trade smarter, not faster.