In financial markets, active traders have numerous options beyond prop firms. Among the various funding models, traders can choose to self-fund, raise funds from private investors, or trade with brokers or prop firms.

However, each funding model comes with its own limitations and challenges. What works for one person may not work for another. Funding risk, profit splits, regulatory systems, drawdown limits, and time commitments are the fundamental factors to consider before selecting your capital route.

However, in the financial trading landscape of 2025, prop firms remain a dominant choice among seasoned and active traders. Self-funding and brokers work best for traders who want to keep control of their journey in their own hands. This article provides various capital options for traders of all levels, helping them select the best fit. It helps you learn:

- The pros and cons of each trading route.

- Which method rewards active traders?

- Why prop firms take the lead instead of self-funding and broker trading.

Personal Funded Trading

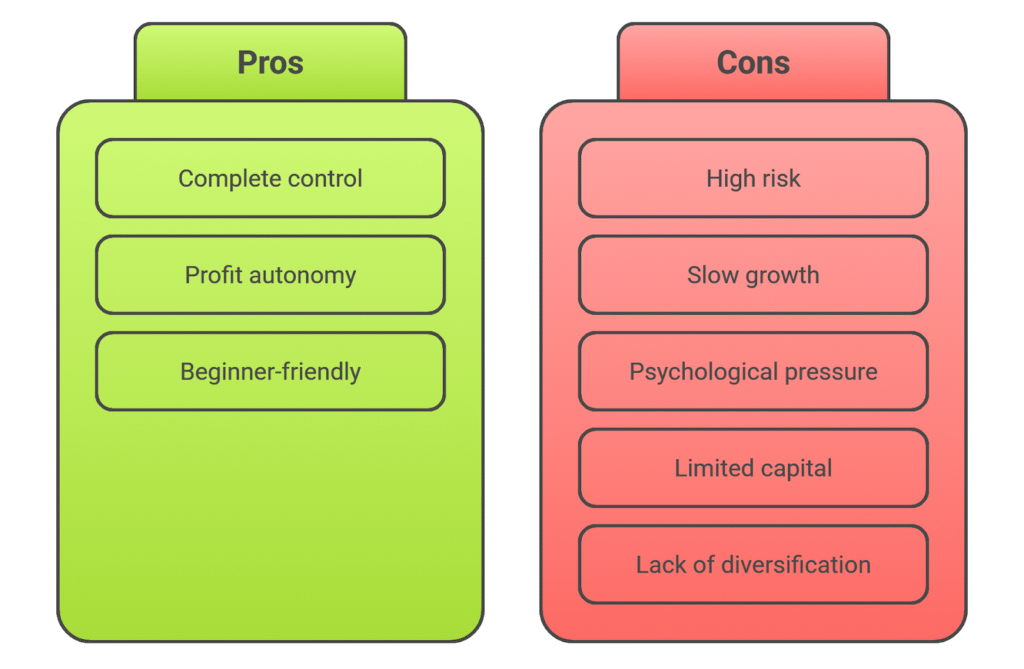

In the trading markets, self-funded trading is one of the most accessible options that many traders prefer. In self-funding, traders use their own capital to engage in trading. Even though this option involves high risk, it gives traders complete control over their profits.

Additionally, they get to decide their trade size, strategies, and risk appetite. It is ideal for traders who want complete control over decision-making and autonomy in their trading journey. However, it has its own drawbacks. If you are short on funds and don’t want to put your finances at risk, you should avoid this avenue.

Personal funded trading reduces your chances of growing your account size through scaling, as the scaling process is gradual and requires long-term compounding to see a considerable difference. Self-funding also puts you under psychological pressure. With your finances at risk, traders sometimes employ poor risk management and may overtrade to compensate for their losses.

It is suitable for beginners and helps them get a hang of the market dynamics. At the same time, it is less ideal for skilled traders due to limited capital exposure and a lack of diversification across markets. Once consistent and profitable, beginners can explore other capital routes.

Trading with Private Investors

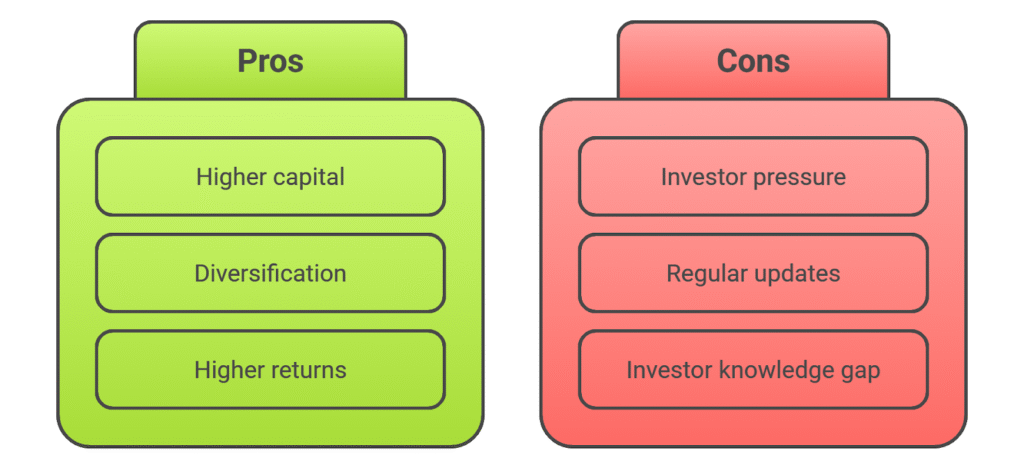

Another common option for active traders seeking the right capital route is trading with private investors. In this, traders manage capital provided by private investors who don’t want to trade themselves. In return, they get returns.

It enables traders to trade with higher capital, allowing them to achieve larger position sizes and diversify across markets as well. However, this approach requires traders to work closely with their investors. Traders must maintain regular contact with investors and keep them updated on the performance and results.

Trading with private investors can also create psychological pressure, as they may not appreciate negative performance due to their limited knowledge of trading. If you are a skilled trader who can work well under pressure and in a demanding environment, then it could be the right capital choice for you.

Funding Structures and Profit Splits

When trading with private investors, the funding structures and profit splits must be clearly negotiated before entering into any formal agreement. The investor provides all the funding. Usually, the investors bear the losses. However, they could impact the traders’ reputation and hinder further funding.

In comparison to losses, the profit is shared by both parties. The investors may decide to retain a higher percentage of the profits for themselves. The best path to success in trading with private investors is that both parties clearly communicate their expectations and desired outcomes. The profit targets, loss responsibility, drawdown limits, diversification, and profit splits should all be discussed in depth to avoid any misunderstandings or confusion later on.

Trading with private investors is not the best capital route for active traders due to its demanding nature and high expectations. However, if the rules are clear and traders trade with discipline and proper risk management, it can yield rewarding profits for both parties.

Broker Accounts and Managed Accounts

Trading with brokers and managed accounts offers distinct benefits and serves different purposes. Here’s the difference between the:

| Type | Broker Accounts | Managed Accounts |

| Market Access | Direct market access to financial markets. | Access to the market through broker accounts on the client’s behalf. |

| Trading Control | Gives complete control over strategy and execution. | Gives control, but client expectations also play a role. |

| Funds | Traders self-fund. | The client provides capital. |

| Loss Responsibility | Traders bear all losses. | Mostly, the client bears the losses, but it impacts future funding for the trader. |

| Regulatory Rules | Vary by broker and region. | Broker, along with reporting to clients. |

| Profit split | Complete retention. | Clients might get a higher profit percentage than traders. |

| Risk Management | Traders bear full responsibility. | Traders largely manage it with some input from the client. |

| Best For | Beginners | Skilled traders with strong risk management. |

Margin and Leverage Through Brokers

When traders trade through a broker, margin and leverage limits are always in effect. Traders use leverage to control large positions with small capital amounts. For instance, you can use 1:100 leverage to control $10,000 with $100. At the same time, margin is the amount used to maintain that leveraged position. However, leverage comes with its own risks. It aggressively magnifies both gains and losses.

When leverage is used during volatile conditions, there is a high risk of margin calls and forced liquidations when trading with a broker. Brokers expect traders to use leverage responsibly and take it as a risk management tool. Leverage can cause more harm than good when it is repeatedly used, and risk management is not followed correctly.

As an active trader, to sustain and grow your account in the long run, you must manage your position sizes responsibly and employ effective risk management. Otherwise, you may lose it all, to the point of blowing up your trading account.

Institutional Proprietary Firms vs. Retail Options

In the financial markets, active traders can choose between proprietary firms and retail options for capital funding. Both operate differently; here’s how:

| Type | Institutional Proprietary Firms | Retail Prop Firms |

| Definition | Trading with a prop firm using the fund’s resources. | Trading independently with a firm’s capital with predefined rules. |

| Funding | The prop firms provide funds. | Traders risk personal capital for fees only. The firm allocates trading funds. |

| Trader Type | The firm’s employees mostly trade within this setup. | Individual traders trade in the retail environment. |

| Risk Management | These firms have an internal risk management setup, e.g., they monitor trading and may halt it in the event of a risk breach. | These firms follow rule-based risk systems. For example, firms apply drawdown limits, and loss rules govern trading. |

| For Example | Jane Street, XTX Markets, etc. | FTMO, The5ers, etc. |

Given these factors, retail prop firms are more ideal for active traders seeking long-term growth than institutional prop firms. While the retail ones operate on a smaller scale, they provide flexible capital access to traders and offer more opportunities for independent active traders.

Risk-Reward Comparison Across Capital Routes

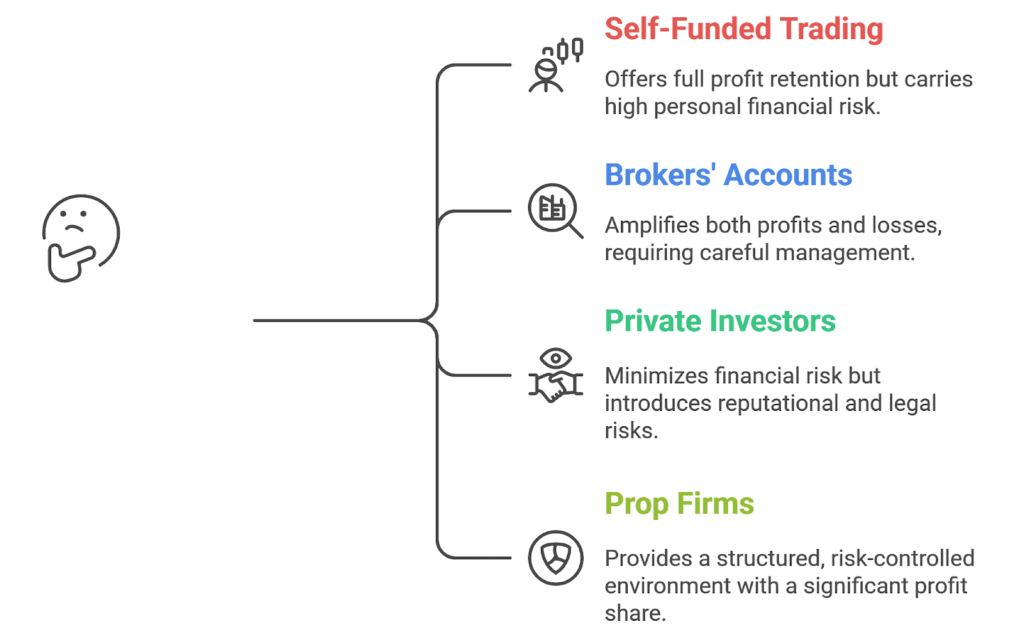

When traders commit to a trading avenue, it is best to assess the risk-reward ratio to gauge the personal risk they are willing to take in comparison to the potential profits. As each capital route has its own benefits and drawbacks, its risk-reward ratio also varies. For instance:

- Self-funded trading: it comes with a huge potential financial risk as each loss impacts the trader’s own finances. In case of gains, traders keep all the profits.

- Brokers’ accounts: these accounts amplify both profits and losses. In both cases, traders are responsible for managing finances.

- Private investors trading: This approach minimizes personal financial risk but maximizes reputational and other legal risks. In the event of profits, both parties share them in accordance with their agreement.

- Trading with prop firms: The firms try to limit potential risk by applying risk rules. While both parties may enjoy potential profits, traders typically retain more than 70% of the profits.

All capital routes come with a potential risk-reward ratio; the prop firm’s route is ideal because traders trade in a structured, risk-controlled environment and enjoy rewarding profits. While the other capital routes offer better profit potential to traders, the risk factor is usually uncontrolled. It requires strict risk management and discipline to sustain the accounts in the long run.

Why Prop Firms Appeal to Skilled Traders

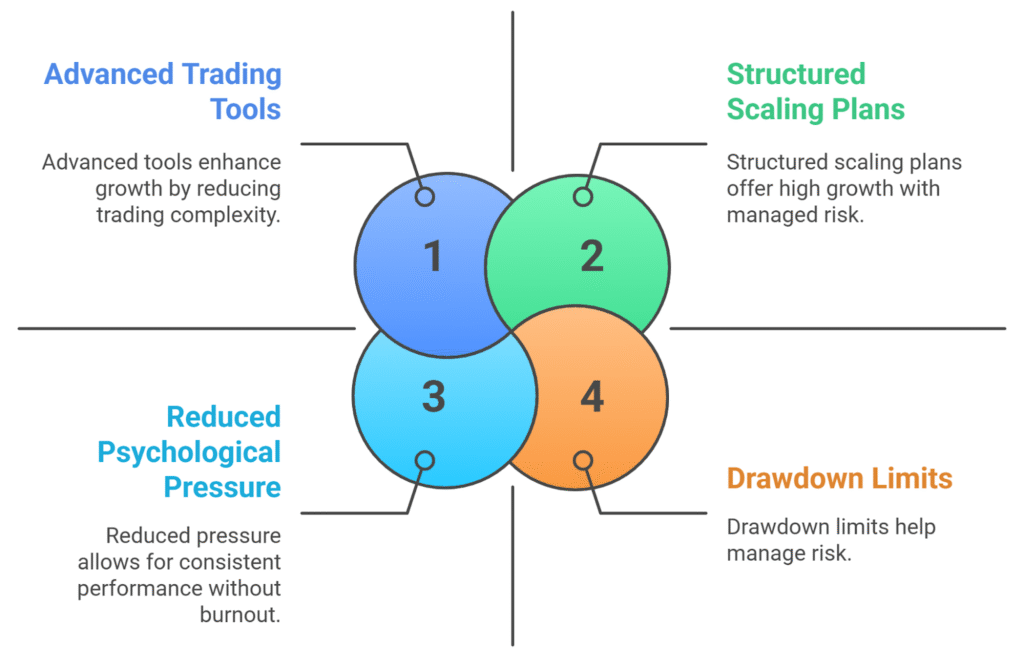

Skilled and professional traders have learned to thrive in high-pressure and volatile environments, demonstrating discipline and consistency over time. A prop firm is typically designed for traders who can withstand volatility, adhere to drawdown limits, and meet profit targets.

The prop firm setup is ideal for skilled traders, allowing them to scale up with structured scaling plans. With personal funds, traders may experience significant psychological pressure and financial risk. Prop firms reduce this risk and pressure by employing structured risk limits. Additionally, the prop firms offer advanced tools and platforms with access across markets. These factors enable traders to trade with less hassle and greater comfort, facilitating their growth and improving long-term performance.

Capital Access and Limited Personal Risk

In a prop firm setup, traders can access more capital with limited personal risk. For instance:

- Traders are only required to pay entry costs for evaluation or challenge models.

- Once traders clear these models, they have access to higher funds than the initial funds they risked.

- In the long run, the risk of losses is minimized due to structured risk limits such as drawdown rules.

- Traders are required to use effective strategies, and if consistent profits are achieved, they are allowed to scale up.

Transparency, Scaling, and Profit Splits

All prop firms are required to be transparent with traders about risk rules, resources, withdrawals, and pricing policies. This transparency ensures that traders don’t have to worry about unexpected inconveniences later and can trade with confidence. Once traders demonstrate consistent profits, they can gradually scale up by meeting each subsequent profit target. This helps traders grow sustainably in the long run. Additionally, all prop firms offer clearly defined profit splits. This helps build traders’ trust and ensures mutual growth.

Whether you are a beginner or an advanced trader, always do your due diligence before committing to any prop firm and check these factors before committing to any. To grow and excel in any environment, you must consistently demonstrate discipline, effectiveness, and effective risk management.

Why Do The5ers Take the Spotlight?

The5ers is known as one of the best prop firms in the financial trading markets. It stands out for its advanced tools, multiple platforms, and easy access to funding for traders of all levels. The firm rewards traders who prefer stable growth in a risk-controlled environment. Traders can choose from multiple funding models, such as:

- Hyper Growth model: it follows a 1-step challenge before funding.

- High Stakes model: It is a 2-step challenge model for advanced traders.

- Bootcamp model: it is a 3-step model best for beginners.

All models require traders to meet profit targets and drawdown limits before getting funded. However, each requires a different time commitment and risk appetite. If you are an active trader and prefer to scale up, The5ers could be the best option for you. And the great news is that you can avail a discount of up to 10% on your first 5%ers evaluation using this link.

Conclusion

Active traders require trading options that reward consistency and discipline, allowing for long-term growth. Traders can choose from multiple funding models, including self-funding, private investors, brokers, and Prop firms. Each framework is designed to target a specific niche. However, all models require traders to show up regularly, be disciplined and practice proper risk management.

Overtrading, overleveraging, and revenge trading are discouraged by all these frameworks. As an active trader, patience and emotional regulation are your best friends. If you can trade in a demanding environment and withstand personal financial capital, trading with a broker or private investors can work for you. Otherwise, prop firms take the lead for traders who prefer a sustainable and stable trading experience.