Every active trader must ask themselves an uncomfortable question at some point: Am I truly trading a skill, or am I just betting on charts?

The answer to this question changes from day to day for many traders, which is why it’s a dangerous proposition. Day trading feels like a casino after a string of losses. It feels professional again after a week of clean execution. The fact that emotions can change so quickly is the first indication that most traders lack a stable framework to manage their emotions.

After years of examining trader data, reading journals, and watching accounts rise and fall, the truth is simple yet not popular. Day trading is essentially gambling when there is no structure. The market doesn’t tell you if you’re gambling. Your process does.

This article isn’t here to defend day trading on an emotional or philosophical level. It is here to separate myth from fact and show exactly where most traders fail, moving from random to skilled.

What the Data Really Says (And What Traders Get Wrong About It)

If you look up whether day trading works, you’ll find studies from the National Bureau of Economic Research and papers in the Journal of Finance that show that most retail traders lose money over time. Many people use these results as proof that day trading is no better than gambling.

However, this is where reading at a surface level can lead to incorrect conclusions.

The same NBER studies on trader performance persistence also reveal something more significant: returns are not random. A small group of traders consistently outperforms the rest, and their results hold up across various market conditions. That alone makes pure gambling theory invalid. In games of chance, the results tend to revert to the average. In trading, there are groups of skills.

The CFTC’s reports on retail trading behavior further support this claim. Traders who standardize their risk, trade less frequently, and set limits on how much money they can lose have a significantly lower failure rate than those who don’t. It’s not prediction that makes the difference between winners and losers; it’s exposure control.

In other words, the study doesn’t suggest that day trading is equivalent to gambling. It concludes that most people trade without the limitations necessary for skill development.

The Real Divider: Random Exposure vs. Controlled Exposure

There is considerable uncertainty in the markets. That never changes. How traders deal with uncertainty changes, though.

A gambler goes into the market to find out if a trade will win. A skilled trader comes in and asks if the trade is worth it, given the risk, the situation, and the conditions. That change in thought is small, but it’s where careers start.

Trading based on skill doesn’t eliminate randomness. It controls how random events affect the account.

When Day Trading Becomes a Skill (And When It Doesn’t)

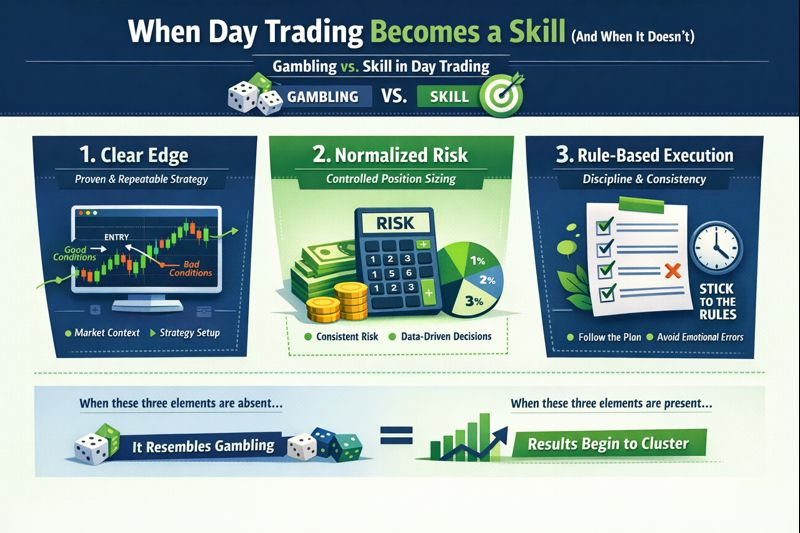

Better indicators or faster execution don’t make the difference between gambling and skill. It happens when three things can’t be changed.

To begin, there needs to be a clear edge. Not a vague idea, but a setup that can be repeated and works best and worst in certain market conditions. If you can’t explain why a setup works in some situations, you’re using variance instead of skill. This is why strategies that take context into account are more effective than those based solely on a single factor. We’ve discussed the topic extensively in our guide to market structure and session-based trading behavior.

Second, risk needs to be made normal. Most traders lose not because they make incorrect trades, but because their emotions influence the amount of risk they take. Two traders can trade the same setup, but one makes a profit, while the other doesn’t, simply because the size of their positions differs. This is where a useful position size calculator can make a big difference. It eliminates the guesswork of risk and converts feelings into data, rather than relying on intuition.

Third, execution must follow the rules, especially after losses. Our internal reviews of trader journals indicate that rule-breaking increases after small drawdowns, rather than big ones. This type of behavior is one of the strongest indicators that a trader is likely to fail in the long run. We discuss it in our list of common execution mistakes that can ruin profitable strategies.

In a statistical sense, day trading resembles gambling when these three elements are absent. When these three elements are present, the results begin to cluster.

Why Gamblers Love the Win Rate Metric

One of the most wrong ideas in retail trading culture is that having a high win rate means you’re good at it. This is what casinos depend on, and many traders don’t even realize they’re doing the same thing.

Traders who know what they’re doing pay more attention to expectancy than frequency. A strategy that wins 40% of the time with payouts that aren’t equal will do better than a strategy that wins 70% of the time but cuts off winners. There is extensive research on this idea in behavioral finance, originating from institutions such as MIT Sloan and SSRN, that examines risk-adjusted returns. However, it is not often applied correctly at the retail level.

Your strategy isn’t strong if it only works when the market is “perfect.” If you stop following the rules after a few losses, the problem isn’t the system; it’s the operator.

The Feedback Loop That Most Traders Never Make

Here’s an uncomfortable truth: many traders are unaware of why they’re losing. They blame the news, algorithms, or volatility, but they lack precise performance data.

Improvement is not possible without a structured approach to journal writing. Professional traders prioritize reviewing, tagging their emotions, and monitoring their adherence to the rules. A structured trade journal template changes trading from guessing to a feedback loop. It holds people accountable and reveals patterns that a profit and loss (P&L) statement alone cannot show.

Many traders also find out here that the edge they thought they had never really existed.

Scaling Capital Without Going Back to Gambling

Even the most skilled traders will eventually encounter a setback. Personal capital limits growth, and this is where many people go wrong by making trades that are too big to yield results.

Professionals handle these challenges differently. First, they demonstrate consistency, and then they utilize evaluation models to expand their capital. The5ers and similar programs aim to identify traders who already exhibit discipline. It’s not luck that helps you pass an evaluation; it’s following a set of rules.

For traders who have a plan but limited funds, the 5ers evaluation account isn’t a gamble; it’s a smart step toward becoming a professional.

So, is day trading a skill or a game of chance?

The moment the structure breaks down, day trading becomes a form of gambling.

It becomes a skill when you can control uncertainty, set risk, and measure behavior.

Most traders never go through that change. Some do, and those are the ones who live long enough to matter.

A Final Challenge

Don’t change your plan this week.

Instead, make your risk the same for all trades, keep a record of every time you break your rules, and look at trades based on how well they were executed instead of how much money you made.

You’re probably moving away from gambling and toward skill, if that makes you feel uncomfortable.