Moving averages are the first thing that every day trader learns. And practically every day trader doesn’t use them right.

I see it all the time in diaries and live sessions. Traders accumulate a 9 EMA, a 20 EMA, a 50 SMA, and a 200 SMA, then wait for a crossover that occurred 20 minutes ago. They come in late, set a broad stop, then attribute the indication when the price goes back up.

Moving averages are not signals. They are context tools. When you stop treating them like buy and sell buttons and start using them as decision filters, they become one of the most potent tools in day trading. This guide is built from real screen time, not textbook theory. We will talk about how skilled intraday traders really use moving averages to set risk, timing, and trade selection.

What the Data Actually indicates: Research-Backed Insight

There has been a tacit agreement among academic and institutional researchers on one point. Moving averages are better at filtering trends than making predictions.

A study published by the CFA Institute on trend-following strategies showed that moving-average-based systems added value primarily by keeping traders aligned with dominant market direction, not by improving entry precision. The edge came from avoiding bad trades, not catching perfect ones.

Research from the Journal of Financial Markets reached a similar conclusion. Simple moving average indicators reduced risk and decreased, but didn’t boost growth. Fewer days trading mean day traders are more mentally stable and trade steadily.

QuantConnect and institutional research desks show that shorter-term EMAs outperform longer-term SMAs during the day when employed with uncertainty and time-of-day filters.

The takeaway for real traders is simple. Moving averages help you answer one question first. Should I look for longs or shorts right now? Everything else comes second.

Practical Trading Framework: How Pros Use Moving Averages Intraday

Instead of asking what the best moving average for day trading is, ask what job the moving average is doing.

Framework 1: Trend Qualification, Not Prediction

A 5-minute or 15-minute chart’s 20 EMA and 50 EMA don’t indicate reversals. They determine the trend in health.

A strong intraday trend occurs when the price holds above a rising 20 EMA and pulls back shallowly. Not shorting the resistance is your task. Wait for downtrends with no moving average break.

If price is chopping through the 20 and flattening the 50, your edge is already gone. No pattern will save you.

Framework 2: The VWAP and EMA Relationship

Many traders read our guide on how institutions use VWAP. When VWAP aligns with the 20 EMA, continuation trades work. When they diverge, fake moves increase.

A simple rule I use. If price is above VWAP but below a declining 20 EMA, I don’t do anything. Many people resign than make money in that setting.

Framework 3: Higher Timeframe Anchoring

Day traders still follow the 200 SMA, the best long-term moving average.

Intraday traders must grab profits faster and come closer to the price when the hourly 200 SMA is above the price. Opposing structural pressure.

When the 5-minute 20 EMA rises and the price is above the hourly 200 SMA, alignment occurs. Growth and confidence increase there.

This multi-timeframe logic is explained further in our article on top-down market analysis for day traders.

Settings for Moving Averages That Work

Risk and Execution: Where Most Traders Fail

Moving averages do not protect you from poor risk decisions.

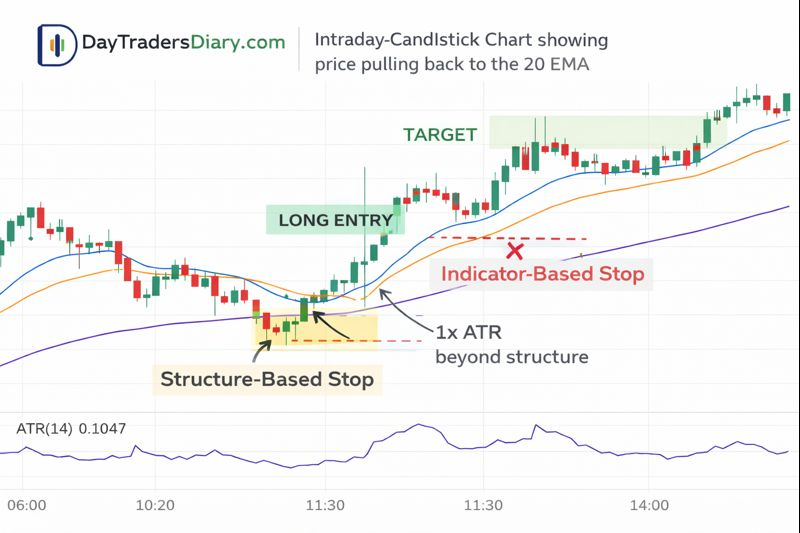

The most common mistake I see is placing stops beyond the moving average rather than beyond the structure. A moving average is not support. Price structure is.

These are where most traders underestimate risk. A position size calculator eliminates guessing and aligns stop distance and account risk.

Not poor luck if you entered late at a moving average touch and your stop is wide. Bad timing.

Optimising Performance with Journaling

Track price behaviour at moving averages to use them.

Write down the following in your trade journal:

• The trend’s direction compared to the 20 and 50 EMA • How far away the entry is from the moving average • If the moving average was going up, down, or staying the same

When you look at statistics rather than feelings, patterns show up immediately. Our Trade Journal Template is made to get this exact information without making things messy.

After twenty trades, you will know whether you trade pullbacks too early, too late, or against trend. Most traders never reach this clarity.

Scaling Edge and Capital Growth

A consistent moving average strategy creates something more valuable than profits. It makes things more predictable.

The issue is money. Even significant intraday edges have a hard time compounding meaningfully on tiny accounts because of risk limits.

This is why knowledgeable traders look for analysis programs. Firms like The5ers, FTMO, and Topstep allow traders to use rule-based strategies with more money without stress.

The realistic drawdown structure and longer evaluation timeframes make The5ers’ review approach ideal for trend-following traders. Patience beats gambling.

Working with a prop firm is a legitimate next step if you have a proven day-trading approach, a moving average, and clear KPIs.

Frequently Asked Questions

Do moving average crossovers aid day trading?

Low frequency. The price is due to crossovers. Confirmation is their strength, not entry.

Forex and equity trading on the same day: what is the best moving average?

The 20 EMA is great for intraday strength because it works with many things. Efficiency depends more on the market structure than on the asset.

Do moving averages function in stormy markets?

No. They are mostly used for sifting chop, not trading.

Conclusion: Your Challenge to Take Action

For 10 sessions, remove all indicators except VWAP and moving averages. Just pay attention to the trend alignment and the decline.

Don’t make things more complicated than they need to be. Put rules in place.

Reread our price action endorsement article to improve moving average trades.