Most traders don’t blow accounts because they can’t read charts.

They blow them because they misjudge volatility.

I’ve watched this play out hundreds of times. A trader has a clean setup, solid entry, and decent timing, but the stop is too tight for today’s volatility, or the target is unrealistic for the session’s range. The trade fails, not because the idea was wrong, but because the price never had enough room to behave normally.

That’s where ATR comes in.

Not as an indicator to “predict” price, but as a decision filter. When used correctly, ATR doesn’t tell you where the price will go. It tells you what is reasonable to expect, and more importantly, what is not.

This article isn’t a generic explanation of the ATR indicator. It’s a practical, experience-built framework for using ATR in real day trading decisions, entries, stops, targets, position sizing, and expectation management, the things that actually move the equity curve.

What Research Tells Us About Volatility (And What Traders Usually Miss)

Volatility has been studied extensively, but traders often misapply what the data actually shows.

Research published through the BIS (Bank for International Settlements) and SSRN volatility studies consistently highlights three facts relevant to day traders:

- Volatility clusters , high-volatility periods tend to follow high volatility, and low-volatility periods follow low volatility.

- Realised volatility, not just directional bias, imposes significant limits on short-term returns.

- When position size changes with volatility rather than remaining constant, risk-adjusted performance improves.

This means in real life:

- Your strategy doesn’t fail by chance; it fails when you use it outside of its volatility window.

Across all sessions, fixed stops and targets are structurally flawed.

- Consistent traders don’t “predict” better; they know how to match risk to market conditions better.

ATR (Average True Range), initially introduced by Welles Wilder, isn’t predictive , but it is one of the cleanest real-time volatility measures available to a discretionary trader.

The edge isn’t in knowing ATR.

The edge is in how you use it to limit bad decisions.

How to Calculate ATR in Trading (And Why the Formula Matters Less Than the Context)

In a technical sense, ATR is the average range over a certain number of periods, usually 14. Accurate Range accounts for the current high and low.

Gaps from the last close

Most platforms do this automatically, so traders don’t miss an edge by knowing the formula.

What matters more is which timeframe you apply it to.

For day trading:

- ATR on the daily chart defines the maximum realistic expansion for the session

- ATR on the intraday chart defines noise vs meaningful movement

Confusing these two is the main cause of most ATR misuse.

A Practical ATR Framework for Day Trading Decisions

1. Using Daily ATR to Set Realistic Expectations

Before the session starts, ask one question:

How much of today’s ATR has already been consumed?

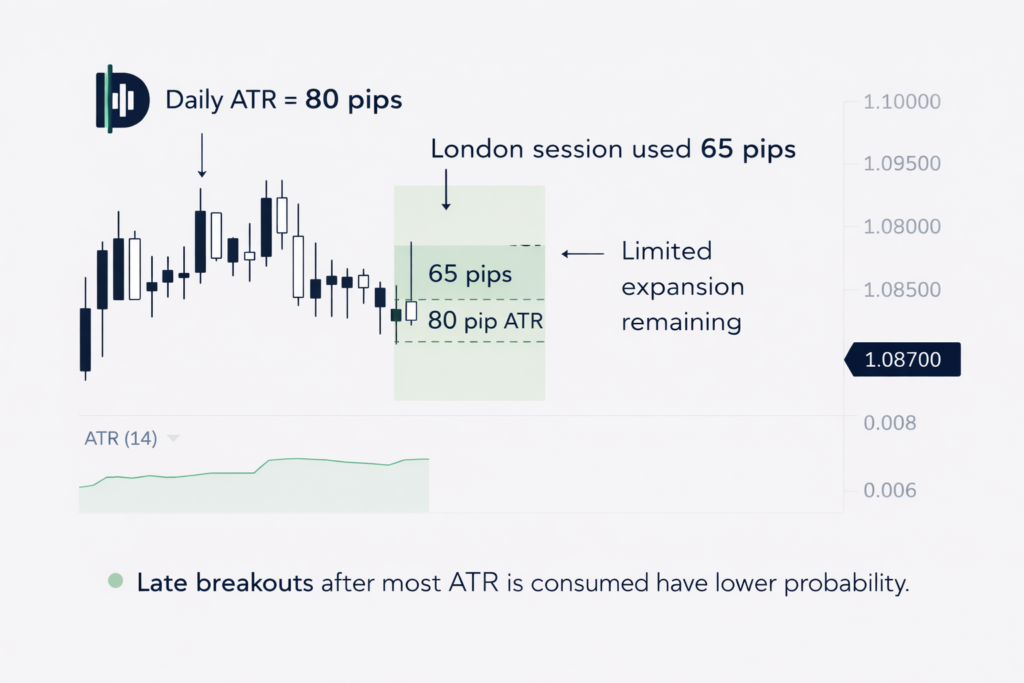

If EUR/USD has a 14-day ATR of 80 pips and the price has already moved 65 pips by London close, expecting another full directional expansion is statistically weak.

This is where many breakout traders fail, they trade late-stage volatility as it’s early.

ATR helps you avoid forcing trades when the market has already done its job.

This concept aligns closely with how professional traders structure session-based bias, something we’ve discussed previously in “What Time Frames Do Day Traders Use?“

2. ATR-Based Stops: Why Fixed Pip Stops Fail

Fixed stops ‘ignore volatility’ is not an opinion, it’s math.

If your target needs 1.5 times the remaining session ATR, you’re not trading; you’re hoping.

Most of the time, high-probability intraday targets are found in:

- 0.3 to 0.7 times the daily ATR for continuation trades

- 0.2–0.4 times the daily ATR for mean reversion. ATR doesn’t limit profits; it just eliminates unrealistic expectations.

3. Where ATR You’re Not Work (And How Professionals Deal With It)

ATR does not:

- Guess when breakouts will happen.

- Find out which way the trend is going

- Change the structure of the market

Most of the time, ATR fails when:

- Expansions based on the news

- Changes in the regime (from volatility compression to expansion)

- Overlapping illiquid sessions

Professionals change by:

- Increasing the ATR lookback during high-impact news

- No trading during inactive hours

Risk and position size are the silent killers of your account. If you don’t change the size of your position, ATR-based stops are useless.

Most traders get the risk wrong here. A position size calculator takes the guesswork out of it and makes you stick to your plan when volatility rises.

ATR defines distance.

The position’s size determines the damage.

One that is ignored breaks the system.

Writing down ATR decisions (this is where Edge Compounds come in)

If you don’t write down ATR-related choices, you’re giving out information.

Keep track of: ATR at entry

Size of stop as a percentage of ATR

Target as a percentage of the remaining ATR

What happened vs. what was expeisn’tPatterns show up quickly.

To find out what you need, use the Trade Journal Template on DayTradersDiary.com.

Too much trading in the late Range

Always tight stops in times of high volatility

Choosing targets that aren’t realistic

This is how discretionary traders turn their knowledge into numbers.

Scalindon’t ATR-Based Edge Without Capital: Volatility-adjusted edges scale cleanly , but only if capital allows it.

This is why serious traders eventually look beyond personal accounts. Not for shortcuts, but for capital efficiency.

Programs like The5ers evaluation account exist because firms understand something most retail traders ignore:

Traders with volatility-adjusted risk models survive longer and perform more consistently.

If you’ve learnt to be disciplined about ATR, execution, and journaling, an evaluation account is a professional step, not a risk.

Think about whether your current capital structure is holding back your growth more than your strategy.

Final Thought: A Simple Challenge

Don’t change your plan tomorrow.

Make one change:

Find out how much volatility you want the market to give you and if that request is fair.

ATR won’t make you right.

But it will stop you from being unrealistic , and that alone saves more accounts than most indicators ever will.

Next read:

You can learn more about this framework by reading “When Day Trading Becomes a Skill (And When It Doesn’t).” It combines volatility, don’tpline, and expectancy into one performance model.

ATR for Day Trading: Frequently Asked Questions

Is ATR a good tool for day trading?

Yes, but not as awful. It is a way to think about stops, targets, and expectations.

What is the best ATR period for day traders?

Most people use 14, but professionals change the period based on how volatile the market is and how it behaves during the session.

Don’t I use ATR on the daily chart or the intraday chart?

Both: daily ATR to set expectations for the session and intraday ATR to inform decisions on when to act.

Can ATR replace support and resistance?

No. It adds to structure; it doesn’t take its place.