Most day traders do not fail because they lack a trading plan. They fail because their plan is too complicated to execute under pressure.

I have reviewed hundreds of trading plans over the years. Many look impressive on paper. Multiple setups, layered indicators, complex rules for every possible scenario. Yet when the market opens and volatility spikes, those same traders freeze, improvise, or abandon the plan entirely.

A trading plan is not supposed to impress you. It is believed to protect you on your worst trading days and keep you consistent on your best ones. This guide is not a theory. It is built from real execution failures, drawdowns, performance data, and the uncomfortable lessons that come from trading size when mistakes actually hurt.

If you already understand basic day trading concepts and want an edge, the goal here is simple. Build a plan so clear that even your worst version can follow it.

What Research Tells Us About Planning and Execution

There is a lot of proof in both finance and behavioural psychology that making things simple makes it easier to make good decisions when you’re stressed.

A famous study from the CFA Institute on behavioural biases demonstrates that traders tend to overtrade and break regulations when the market is unpredictable because they are too confident and the restrictions are too hard to understand. When traders get emotional, they become pickier about which rules to obey, the more regulations they have.

Research from the Journal of Finance on discretionary trading performance highlights that traders with predefined decision rules outperform those relying on flexible judgment during intraday volatility. The key is not rigidity. It is clarity.

Even outside trading, work published by Nobel laureate Daniel Kahneman shows that when decisions must be made quickly, humans default to heuristics. If your plan does not align with how your brain works under pressure, it will not survive real markets.

For day traders, the takeaway is practical. A simple trading plan reduces cognitive load, lowers emotional interference, and improves repeatability. That is where edge actually compounds.

The Simple Day Trading Plan Framework

A functional day trading plan answers five questions. Nothing more.

1. When Am I Allowed to Trade?

Most traders underestimate how much damage bad timing causes.

Your plan should clearly define:

- Market sessions you trade

- Days you do not trade

- Conditions that cancel your trading day

For example, many experienced traders avoid the first five minutes of the open or skip trading on major economic release days. This is not fear. It is selectivity.

If you struggle with overtrading, this section alone can reduce half your mistakes. If you want deeper context on timing decisions, revisit the article on what time frames day traders use and how session volatility changes behaviour.

2. What Is My One Primary Setup?

If your plan has more than two setups, it is probably not a plan. It is a wish list.

A good strategy has one main setup that works with your personality and how you want to do things. Trend continuance, breaking the starting range, pulling back to VWAP, or increasing volatility. How well you grasp the arrangement is more important than what it is.

Your plan should say:

Needed: market structure

You require confirmation

One evident point of invalidation

If you keep changing your strategies, it usually means that your setup isn’t clear, not that the market is flawed.

If you trade the EURUSD pair and want to know more about indications without making your chart too busy, you might want to connect this to the post on the best indicators for day trading that pair.

3. Where Do I Enter, Exit, and Accept I Am Wrong?

This is where most plans become vague. Vagueness is expensive.

Your plan must specify:

- Entry trigger

- Stop placement logic

- Profit-taking approach

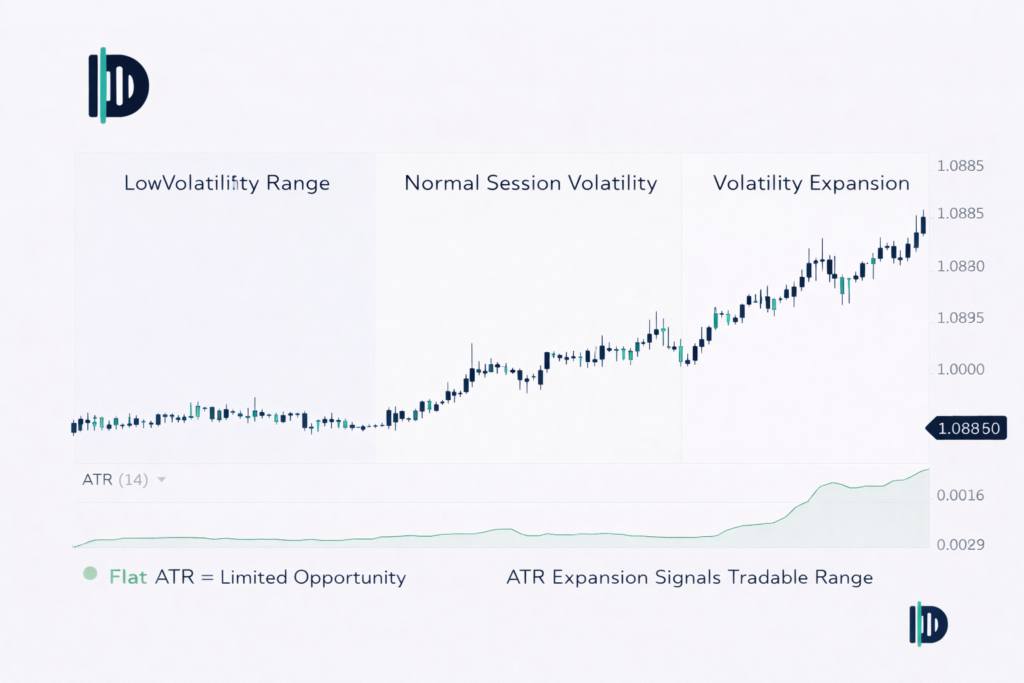

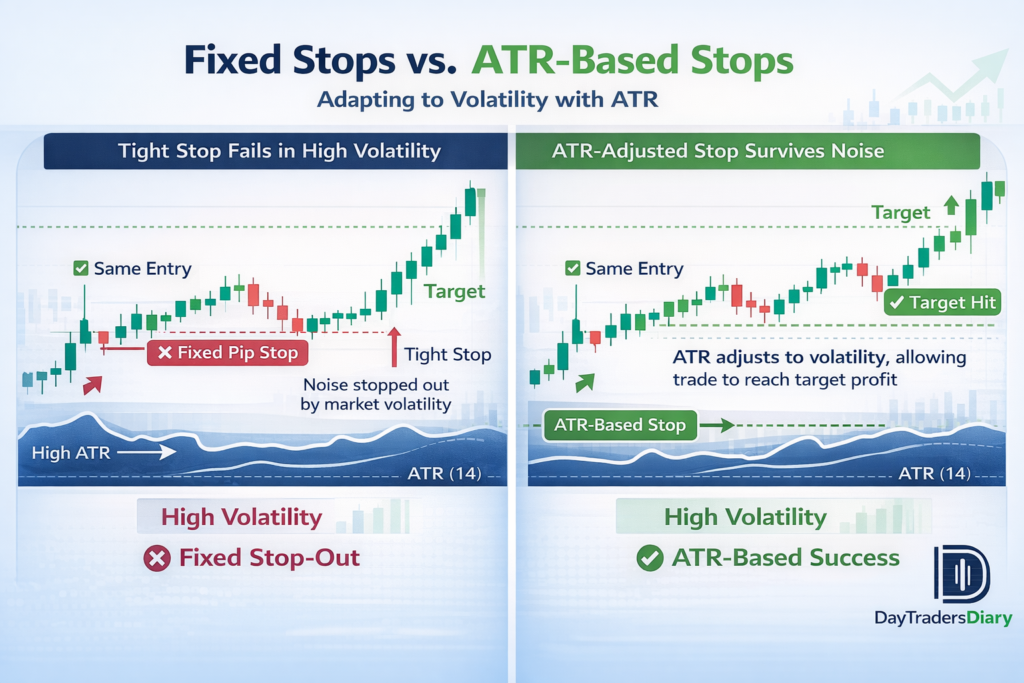

Avoid fixed pip or point targets without context. Market structure, volatility, and liquidity matter. Tools like ATR can help normalize expectations, which is covered in detail in our guide on using ATR for day trading decisions.

A simple rule example:

If price breaks structure and holds above VWAP with rising volume, I enter on the first pullback. If the structure fails, I exit immediately.

Clear logic removes hesitation.

4. How Much Do I Risk Per Trade?

It’s not about the percentages. It’s about being able to handle your feelings and keep your account.

Your plan should say:

The most risk you can take per deal

Maximum loss each day

Maximum loss per week

This is where most traders make mistakes when they use mental maths to figure out risk.

If your risk model is unclear, every other part of the plan eventually collapses.

5. When Do I Stop Trading?

The ability to stop is more important than the ability to enter.

Your plan should include hard stop conditions such as:

- Two consecutive losses

- Reaching daily loss limit

- Clear loss of market conditions

Professional traders protect their psychological capital as aggressively as their financial capital.

Why Simple Plans Work and When They Fail

Simple plans succeed because you can carry them out even when things get tough. They fail when traders think that simple means lazy.

Even a simple plan needs:

A deep understanding of one setup

Hundreds of times

Brutally honest review

If you don’t write in a journal or follow the guidelines all the time, ease won’t benefit you. Discipline makes things easier. Ego destroys it.

Risk, Execution, and Real-World Discipline

First and foremost, your trading plan is a way to control risk. Second, a strategy document.

Most of the time, execution problems don’t happen because you don’t know enough. They originate from having too big a position size for your emotional control.

This is why serious traders define risk before they define profit. Using a position size calculator ensures that every trade fits within your plan, regardless of stop distance or volatility.

If you feel different emotionally on each trade, your sizing is inconsistent, even if the setup is valid.

Journaling and Performance Optimisation

A trading plan is only a plan if you write it down.

You should keep track of:

If deals went as planned

The state of mind before and after the market conditions that affected execution

Patterns start to show themselves over time. You can find that one setting works well only during certain sessions or that execution issues happen more often after losses.

Using a structured Trade Journal Template makes things easier and forces you to look at things objectively. The idea is not to criticize yourself. The goal is to make the plan better so that it works with how you really trade, not how you wish you did.

Scaling, Capital Constraints, and Professional Pathways

Even a strong trading plan hits a ceiling without capital.

This is where many disciplined traders stall. They have an edge and control, but a limited account size. Professional evaluation programs exist to solve this exact problem.

Firms like The5ers, FTMO, and others offer structured assessment accounts that reward consistency instead of gambling. The attractiveness doesn’t come from leverage. It is access to money with rigorous rules about risk.

For serious traders, evaluations are not a quick way to get ahead in their careers. An assessment account makes sense as a part of your process if your strategy is straightforward, can be done again and again, and has clear risks.

If you make money consistently on a modest account, think about whether increasing through a The5ers evaluation fits with your long-term goals.

Closing: One Action That Changes Everything

If your trading plan is hard to follow, make it easier by taking away a rule instead of adding one.

This week, make sure to follow through with one setup with a consistent level of risk and write down every trade honestly. Don’t optimize. Don’t make changes in the middle of a session. Just do it.

New strategies don’t usually help day traders get better. It arises from following fewer rules more closely.

As a next read, revisit our article on day trading vs gambling to reinforce the mindset difference between structured execution and emotional decision-making.

Your plan does not need to be perfect. It needs to be followed.