Most traders don’t fail because they picked the wrong strategy.

They fail because they picked the wrong time frame for their psychology, capital size, and execution skill, and they only realized it after months of losing money.

I’ve seen traders work hard at day trading, get worn out, and then switch to swing trading to find “calm,” only to lose money on overnight gaps. I’ve also seen swing traders switch to day trading in search of control, only to end up trading too much.

This article is intended for experienced traders, not for beginners.

This is about something deeper than setups, indicators, and risk basics. It’s about matching your trading style to how you really act under pressure, not how you think you should trade.

What High-Quality Research Reveals (But Retail Traders Rarely Apply)

Well-known research by Barber & Odean (Journal of Finance) shows that frequent traders underperform after costs. Most blogs stop there and declare day trading “bad.”

That’s lazy analysis.

The data doesn’t prove that short-term trading fails. It proves that poor decision-making under high frequency fails. The distinction matters.

At the same time, BIS and CFTC research on market microstructure indicates that intraday price movements are primarily driven by liquidity, order flow, and volatility clustering—not by clean directional narratives. This means that day trading rewards those who can execute trades accurately and manage risk effectively.

On the swing side, SSRN studies on holding-period risk suggest that external events, such as macroeconomic news, gaps, and regime shifts, have a significant influence on returns over several days. Retail traders often underestimate this because the pain is rare but severe.

Practical takeaway for traders:

- Day trading is an execution-dominant game

- Swing trading is a risk-containment and patience game

- Most traders fail because they apply the wrong mental model to the wrong timeframe

A Decision Framework Traders Actually Use (Not “Pros and Cons”)

Instead of asking which is better, professional traders ask which style exposes fewer weaknesses.

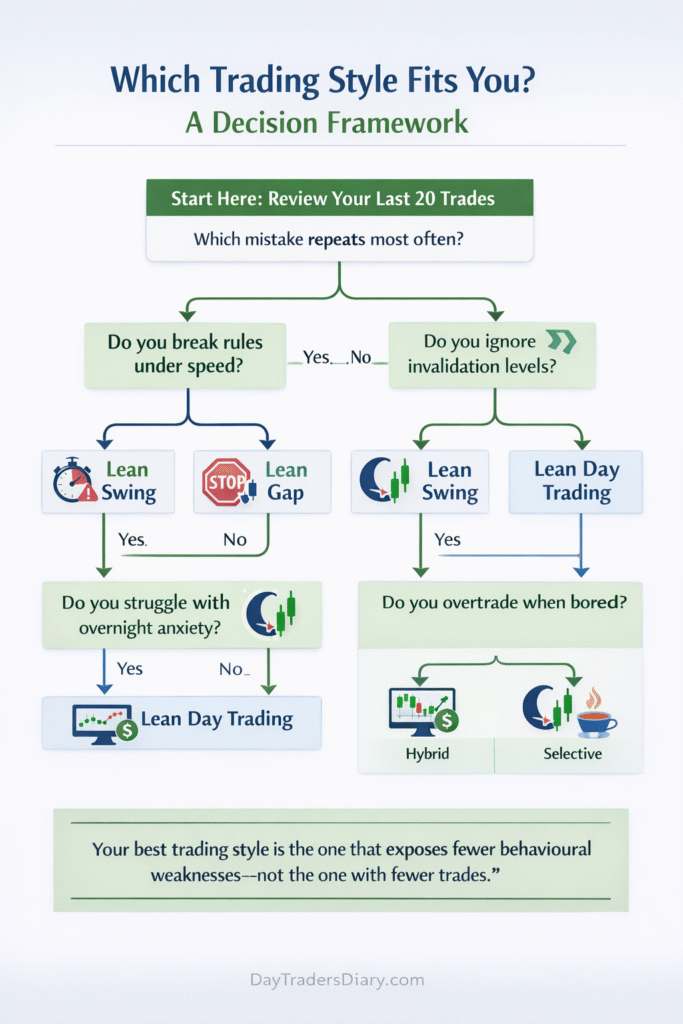

Framework 1: Identify Your Dominant Error Pattern

Check out your last 20 to 30 trades.

If you do this all the time:

- Trade too much after losing

- Close early on the winners

- When speed goes up, break the rules.

Unless you already have excellent execution discipline, day trading will exacerbate those problems.

If you do these things all the time:

- Hold losers past invalidation points

- Don’t worry about news risk

- Wait to leave because “it might come back.”

Swing trading is likely becoming a passive risk exposure rather than a strategy.

The mistake isn’t the style; it’s trading a timeframe that punishes your weakest behavior.

Framework 2: Continuous vs Intermittent Feedback

Day trading provides you with constant feedback. You know right away if you’re wrong. For some traders, that makes them less anxious and stops them from denying.

Swing trading gives you feedback from time to time. You have to be okay with not knowing what will happen, being exposed overnight, and having to wait for a solution to emerge. Many traders think they can handle this until the first gap wipes out weeks of disciplined work.

This is where the idea of swing trading, akin to gambling, quietly emerges. When risk is no longer actively managed, holding becomes hoping.

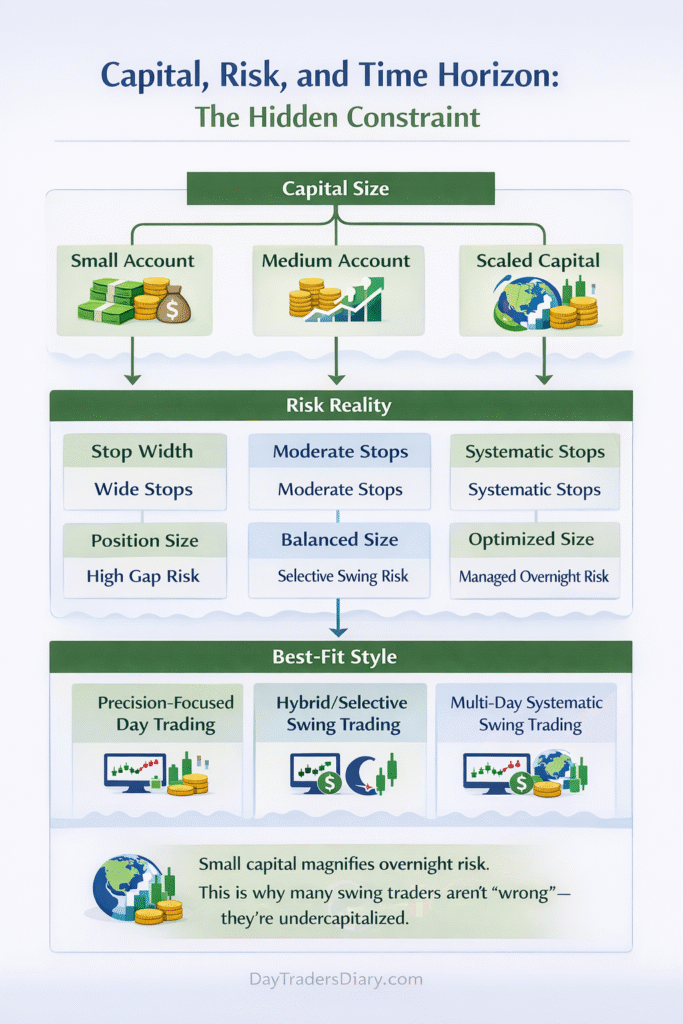

Framework 3: Capital Structure Reality

This is where most online comparisons typically fall short.

Small accounts struggle with swing trading because:

- Stops must be wider

- Position sizes shrink

- One gap can erase multiple winners

Day trading, combined with strict position sizing, often enables you to better control your risk. This is where most traders miscalculate their risk. A position size calculator takes the guesswork out of it and makes sure that you stay consistent when your emotions run high.

Why Switching Styles Rarely Fixes the Problem

Most traders switch styles after pain, not insight.

They leave day trading due to stress.

They leave swing trading due to boredom or sudden drawdowns.

But execution flaws don’t disappear when the timeframe changes.

They mutate.

Overtraders become overholders.

Impatient traders become denial traders.

Before changing styles, traders should analyze behavioral errors, not strategy logic. This is exactly why a structured trade journal template matters, not for tracking profit and loss (P&L), but for identifying repeated decision-making failures.

Risk and Execution: Where the Edge Actually Lives

There is no argument among professional traders about day trading vs. swing trading.

They make the risk the same.

That means:

- Set percentage risk for each trade

- Levels of invalidation that have already been set

- Limits on daily or weekly drawdowns

Without this, every plan seems random. Even simple methods last longer with it.

Consistent traders differ from those who are always learning because they possess discipline in execution, not time.

Journaling for Performance, Not Ego

Most traders journal to feel productive. Professionals’ journal to eliminate errors.

Effective journaling focuses on:

- Entry quality

- Exit discipline

- Rule adherence under stress

The key weekly question isn’t “Did I make money?”

It’s “Which mistake keeps repeating regardless of market conditions?”

That answer tells you whether day trading or swing trading actually fits, or whether you need to repair fundamentals first.

Scaling the Edge: Why Capital Eventually Becomes the Bottleneck

Here’s a reality most traders avoid:

Even a solid edge compound slowly on a small capital.

This is why disciplined traders eventually look beyond personal accounts. Not for shortcuts, but for capital efficiency.

Evaluation programs like The5ers exist because they reward:

- Consistency

- Drawdown control

- Process-driven trading

If you’ve developed discipline but feel limited by account size, exploring a The5ers evaluation account is a professional progression, not a gamble.

Final Takeaway for Serious Traders

The best trading style isn’t the one that feels calm.

It’s the one that exposes your weaknesses the least while rewarding your strengths the most.

Your actionable challenge:

- Look over your last 20 trades.

- Find the mistake that happens most often during execution.

- Change the process, not the strategy.

If you want to learn more, read about execution psychology and decision fatigue. Most trading failures occur because of behavior rather than strategy.

FAQs

Is day trading better than swing trading?

Neither is better universally. The right choice depends on execution discipline, risk tolerance, and capital size.

Why does swing trading fail for many retail traders?

Underestimating overnight risk, widening stops, and passive trade management are common causes of this issue.

Is swing trading gambling?

It becomes gambling when trades are held without predefined invalidation levels or quantified risk.

Can beginners day trade?

Beginners benefit from faster feedback only if risk is tightly controlled.