Most beginner forex day traders do not fail because their strategy is bad. They fail because they start trading before understanding what kind of trader the market is allowing them to be that day.

This pattern repeats itself constantly. New traders move from one setup to another, trying a London breakout one week and RSI scalping the next. They assume consistency comes from finding the perfect strategy. In reality, consistency comes from ensuring that market conditions, execution speed, and your willingness to make decisions are all in sync.

This guide does not include a list of previously used setups. It is based on real trading experience, drawdowns, and performance data. The goal is to help new traders stop letting their emotions get in the way of making structured decisions during their day trading.

What Data Says About Day Trading

Before discussing strategies, several myths need to be corrected using credible research.

The Bank for International Settlements has found that during certain liquidity windows, especially when major sessions overlap, the price of forex moves significantly throughout the day. Outside of these times, the price tends to stay the same, trick traders, and go back down without following through.

Research on behavioral finance published on ResearchGate indicates that inexperienced traders tend to underperform mainly because they trade too much when the market isn’t good and don’t size their positions consistently after wins or losses.

CFTC market structure reports show that retail traders are most active when liquidity is low, which increases execution costs and leads to false signals.

It’s clear what this means for real day traders. Less trading during good conditions is better than trading all day long. When execution discipline is high, simple strategies work better than complicated ones. The real advantage comes from knowing when to stay out of the market.

Beginner’s Decision Framework Before Choosing Any Strategy

Before selecting a day trading strategy, beginners need a clear decision-making framework.

At the start of each trading session, three questions should be answered.

Is the market trending or ranging today?

If price is making higher highs and higher lows on the 15-minute and 1-hour charts, fading price moves is usually a losing approach.

Where is liquidity most likely to enter the market?

Session opens, previous day highs and lows, and well-defined intraday levels matter more than indicator signals.

How fast does execution need to be? If a strategy requires instant decision-making but hesitation is a problem, the strategy is mismatched to the trader.

Answering these questions consistently prevents most beginner mistakes before a trade is placed.

Strategy 1: Session-Based Momentum Trading

For beginners, session-based momentum trading is a good way to get involved in the market without making analysis too hard.

Traders don’t try to guess when prices will change. Instead, they follow institutional order flow during periods of high liquidity, such as in London and New York. When liquidity enters the market, inefficiencies are quickly corrected, and the price either stays strong or drops sharply.

In practice, this means finding a directional bias on a longer time frame, waiting for a controlled pullback at the start of the session, and confirming that the trend is continuing through price structure instead of indicators.

It works for beginners because it limits trading hours, simplifies decision-making, and provides clear invalidation points.

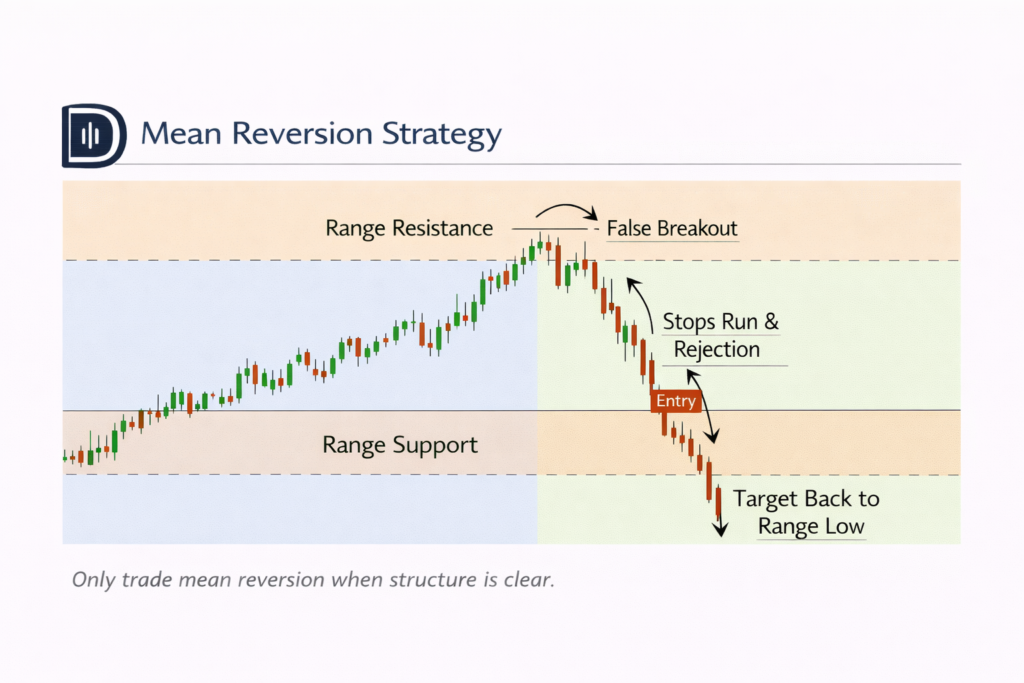

Strategy 2: Mean Reversion Strategies (Need a Clear Market Structure)

Not every trading day has a trend. When beginners try to use momentum strategies in range-bound markets, they often lose money slowly.

Mean reversion only works when the market has a clear structure. You need a clear intraday range, repeated failed breakouts, and clear rejection at key levels.

A common mistake that new traders make is to fade a price just because it looks like it’s going up. Effective mean reversion waits for acceptance failure, where the price cannot hold beyond a level and quickly returns to the range.

Strategy 3: Scalping with One Timeframe and Strict Limits

Scalping attracts beginners because of its fast feedback, but it exposes emotional weaknesses quickly.

If scalping is chosen, traders should restrict themselves to one timeframe, one session, and one specific market condition. Scalping works best when spreads are stable, execution is consistent, and trading stops once the session objective is reached.

Most scalpers do not lose because their entries are poor. They lose because they continue trading after their edge has disappeared.

Where Most Strategies Fail: Risk And Execution

Many strategies fail not because of poor logic, but because of inconsistent risk management.

Two identical setups, with different position sizes, produce very different psychological outcomes. When position size fluctuates, discipline deteriorates.

This is why using a Position Size Calculator is critical. It removes guesswork and prevents emotional scaling after wins or losses. When risk per trade changes, the strategy itself changes.

Turning Strategies Into Skill Through Journaling

Strategies improve only when traders improve.

Effective journaling involves more than tracking profit and loss. Traders should record market conditions, the strategy used, emotional state during execution, and adherence to trading rules.

A structured Trade Journal Template helps transform raw trade data into meaningful feedback. Over time, it becomes clear why a strategy performs well on certain days and fails on others.

Scaling Without Blowing Trading Accounts

Personal capital limits long-term growth, even when there is a consistent edge.

This is why many disciplined traders look into funding models based on evaluation. The5ers evaluation account and other programs reward consistency, risk control, and making decisions based on a process.

If a trader can’t pass an evaluation, it shows what they need to work on before they risk more money. For traders with a proven method, evaluation accounts offer a professional way to grow their business responsibly.

FAQs

What is the best way for beginners to day trade in Forex?

Instead of choosing the one with the highest advertised win rate, the best strategy is one that aligns with session liquidity, market structure, and the trader’s execution style.

How many trades should a new trader make each day?

Most days, there are fewer than 5 trades. More frequent trading usually leads to more emotional mistakes without improving performance.

Do indicators matter to people new to day trading?

Most beginners think indicators are more important than they really are. The market structure, timing, and how you manage risk have a greater effect on results.

Is it possible for beginners to make money day trading Forex?

Yes, but only if trading is considered a structured way to make decisions instead of a way to find setups all the time.

Final Thoughts

Beginners should focus on mastering one market condition, one execution window, and one consistent risk model, rather than trying to learn many different strategies.

For the next week, spend less time trading and more time looking over your trades. Find out why your best trade worked, not just that it did.

As a next step, revisit DayTradersDiary.com’s guide on calculating risk per trade. This is where many otherwise solid strategies quietly lose their edge.