Most EURUSD day traders are not losing because they picked bad indicators.

They are losing because they expect indicators to forecast prices rather than help them frame decisions.

EURUSD is one of the most liquid instruments in the world. That liquidity compresses edges. It punishes traders who rely on single-indicator signals and rewards those who understand when and why indicators work.

This article is not about stacking tools. It is about using a small, intentional set of indicators that align with intraday FX behavior, backed by fundamental research and actual trading logic, not theory.

If you already understand basic technical analysis and want a functional edge in day trading EURUSD, this is for you.

What Real Research Says About Indicators in FX Day Trading

Unlike stocks, FX markets operate continuously and react strongly to volatility regimes and session flows. That matters for indicator effectiveness.

A significant empirical study titled “Technical Trading: Is It Still Outperforming the Foreign Exchange Market?” evaluated more than 21,000 technical trading rules on a variety of currency pairs over several decades. There was no doubt about the outcomes: some rules based on signs can function better in particular instances, but the results aren’t always the same.

(From: https://www.cicfconf.org/sites/default/files/paper_412.pdf)

Neely, Weller, and Dittmar conducted a groundbreaking study using genetic programming to examine technical trading rules for important exchange rates. They found excess returns not in the sample, especially when rules were based on market structure rather than predefined signals.

(See https://people.scs.carleton.ca/~dmckenne/5704/Papers/13.pdf)

Recent research on FX technical trading rules with strict data-snooping controls found that short-term profits occur from time to time, especially when the market is highly volatile and moving in a particular direction.

(Source: https://repository.essex.ac.uk/18805/1/1-s2.0-S1057521916301958-main.pdf)

For EURUSD day traders, this is very important:

When you utilise indicators to filter context rather than use them as buttons to enter, they operate best.

Day Trading Time Frames That Matter for EURUSD

Indicator behavior changes dramatically by timeframe. Most consistently profitable EURUSD day traders operate using a layered structure:

The 1H time frame sets the bias and direction for the day.

The 5M or 15M time frame shows how things are set up and how they pull back.

The 1M or 5M time frame makes execution better.

One of the quickest ways to overtrade is to use indicators without following this order.

If you currently use a session-based method like the ones spoken about in DayTradersDiary.com’s London and New York session articles, this structure fits right in.

Indicator 1: VWAP as an Intraday Equilibrium Reference

The Volume Weighted Average Price is a common way for institutions to find out how precise their execution is and what the fair value is. FX doesn’t have a central volume; you can still use VWAP to figure out where to put your trades, not how accurate they are.

Applying VWAP to session openers, especially in London and New York, is the ideal way to trade EURUSD.

What good traders do with it:

If the price stays above London VWAP, it’s less probable that short setups will happen unless the pattern clearly breaks down.

When the price goes back up to VWAP after a fake drop, it usually means that liquidity is coming in, not that the trend is slowing down.

This is how experienced traders focus on intraday balance instead of trying to catch price extremes.

Indicator 2: RSI as a Momentum State Filter

RSI is one of the tools that retail traders get wrong the most.

Academic research that tests momentum-based criteria suggests that momentum lasts in FX markets when they are moving and volatile, but it fades swiftly in ranges.

(Source: https://ageconsearch.umn.edu/record/37487/files/AgMAS04_04.pdf)

When day trading EURUSD, the RSI works best when it is between 50 and 70, not 30 and 70.

It makes sense that RSI staying above 50 during recessions helps the trend continue.

If the RSI doesn’t go back up to 50 following bounces, it usually suggests that not many people are participating.

When the market is trapped in a range, RSI extremes can sometimes mean that the market is fatigued instead of providing you a chance.

This one modification prevents many disastrous deals.

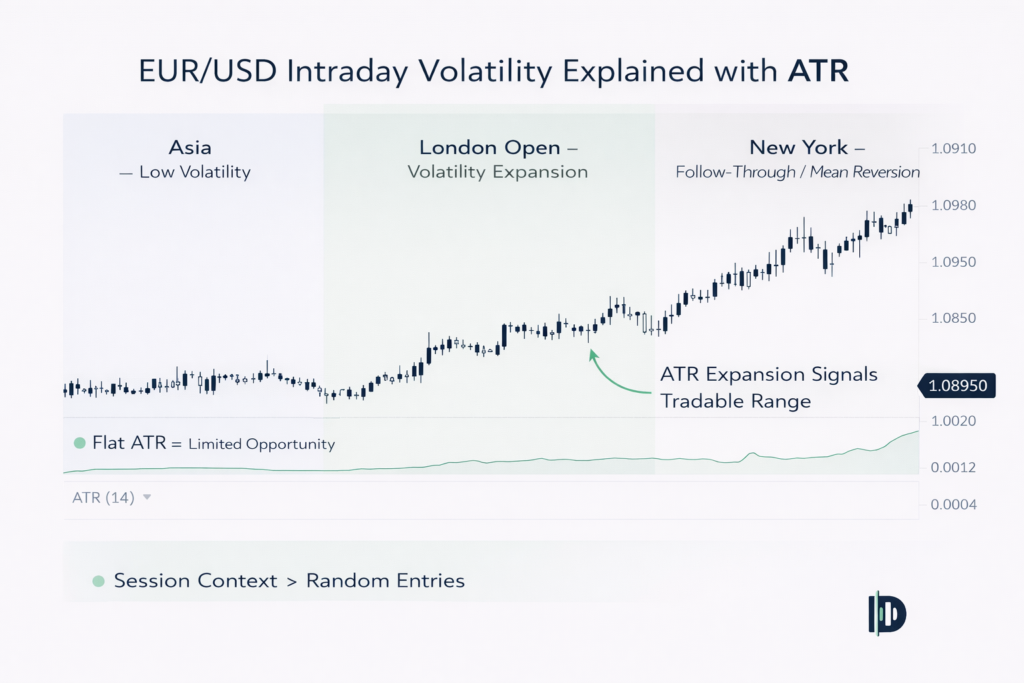

Indicator 3: ATR for Volatility Awareness, Not Just Stops

Average True Range was developed by J. Welles Wilder to measure volatility, not direction. That distinction matters.

Research on FX trading rules indicates that profitability frequently consolidates during periods of volatility expansion rather than during compression.

(From: https://repository.essex.ac.uk/18805/1/1-s2.0-S1057521916301958-main.pdf)

How expert EURUSD traders use ATR:

If the session has already hit or gone over the average daily ATR, it becomes easier to pick trades.

If ATR is growing early in London, setups for trend continuation get better.

If ATR is flat, aggressive trend methods don’t have a good chance of working out.

ATR advises you when not to trade, which is more useful than entry.

Indicator 4: Moving Averages as Structure, Not Signals

Moving averages still matter in FX, but not as crossover systems.

The 20 EMA and 50 EMA on 5M or 15M charts are moving structure references for EURUSD.

A good situation: London bursts out

Go back to the 20 EMA

Price stays above the VWAP, and the RSI stays above 50.

This isn’t a stack of confirmations. It is the alignment of structure, momentum, and involvement.

When moving averages don’t work:

Asia sessions with less liquidity

After news, whipsaw settings are common.

A Practical EURUSD Day Trading Framework

This is how these indicators work together in real time:

First, use ATR and the time of day to define volatility and session context.

Second, use the session VWAP to find a balance.

Third, check the momentum situation with the RSI around 50.

Lastly, apply moving averages and the price structure to carry out the plan.

If one part is absent, the trade is skipped, or the size is lowered.

This approach is a direct reflection of how research demonstrates that technical norms work best when they are conditional, not universal.

Risk and Execution: The Real Edge Most Traders Miss

Most EURUSD traders hurt their own analysis by taking on too much risk.

Research shows over and over that mistakes in position sizing and transaction costs wipe out minor advantages in FX trading. That’s why discipline in execution is more important than accuracy in indicators.

A lot of traders get their risk calculations wrong here. Using a Position Size Calculator removes emotion and forces consistency, especially when volatility shifts.

Risk should change according on ATR and session behaviour, not fixed pip assumptions.

Journaling and Performance Optimization

You can only get better outcomes from indicators if you keep an eye on how they act over time.

Your journal should include:

Session traded

State of ATR

How RSI acts when you enter

VWAP link at the start and end of the trade

The Trade Journal Template lets you see patterns that generic metrics never show, including unsuccessful momentum trades or reversals at the end of the session.

This is where real progress over time happens.

Scaling the Edge With Professional Capital

A consistent EURUSD day trading edge compounds slowly on small accounts.

This is why a lot of disciplined traders end up using evaluation-based funding systems like The5ers, FTMO, or similar companies, not as shortcuts, but as ways to make money after the execution is established.

The5ers’ focus on minimal leverage and risk-adjusted performance fits nicely with structured intraday EURUSD trading.

If your process is good, an assessment account is a smart move, not a risk.

Closing: One Action That Will Improve Your EURUSD Trading Immediately

Stop asking indicators to tell you where the price will go.

Start asking what conditions they describe.

Your challenge:

For the next 20 EURUSD trades, use RSI only as a momentum filter around 50 and journal the outcome.

Edge grows from refinement, not reinvention.

Next read: Explore our in-depth article on EURUSD session liquidity behavior on DayTradersDiary.com to deepen this framework.

FAQs

Do indicators really help with day trading EURUSD?

Yes, but only in certain types of volatility and session regimes.

What are the greatest free indicators for trading EURUSD during the day?

VWAP, RSI, ATR, and moving averages still work effectively when used correctly.

What sessions are optimal for EURUSD trades that use indicators?

The sessions in London and New York have the highest liquidity and the most follow-through.

Is RSI still helpful for traders who are more experienced?

Yes, as a filter for momentum states instead of an overbought tool.