In day trading, traders require numerous tools to thrive and succeed in the market. One of these includes indicators. Day trading revolves around quick intraday price movements where timing and precision play a crucial role. To make informed decisions, traders rely on technical indicators that analyze historical market behavior in real-time.

Moreover, they translate raw market data into quick, actionable insights. So, indicators highlight everything from market trends to momentum, volatility, and participation. However, it is essential to note that while indicators are valuable tools for navigating day trading, they don’t guarantee success. This article covers the best day trading indicators for your trading journey. It helps you learn:

- Most effective indicators to spot intraday trends and momentum.

- How to use RSI, MACD, and volume indicators.

- How to align the right indicators with different market conditions.

- How to build a high-probability indicator for speedy execution and focus.

Why Day Traders Rely on Indicators for High-Speed Market Decisions

During day trading, the intraday markets move too quickly. For this reason, traders use indicators, as they help traders navigate high-speed market decisions. These indicators help traders identify entry and exit points by utilizing structured and data-driven signals.

For instance, let’s look at momentum indicators. These identify if the buying or selling pressure is strong enough to make a call. With the help of these indicators, traders can make informed, precise, and timely decisions. It also minimizes the risk of impulsive decisions, helping traders trade with discipline and consistency. You can learn more about indicators and strategies in free educational resources provided by FTMO and The5ers. You may also join The5ers and avail a discount up to 10%.

How Market Conditions Influence Indicator Performance in Day Trading

In day trading, the market conditions play a crucial role. Each indicator performs differently under different market conditions. Before selecting any indicator, traders must study the market conditions and determine whether the market is trending, consolidating, or otherwise. This helps traders select indicators that work best for their strategy. For instance, trend-following indicators work differently in strong directional markets and range-bound markets.

In the former, they are known to give accurate signals, while in the latter, the chances of them giving false signals increase. On the contrary, momentary oscillators, such as the RSI, are the perfect choice for ranging markets.

Furthermore, traders need to watch out for volatility as well, as it could impact the quality of the signals. Understanding market conditions and utilizing well-aligned indicators enhances precision and accuracy.

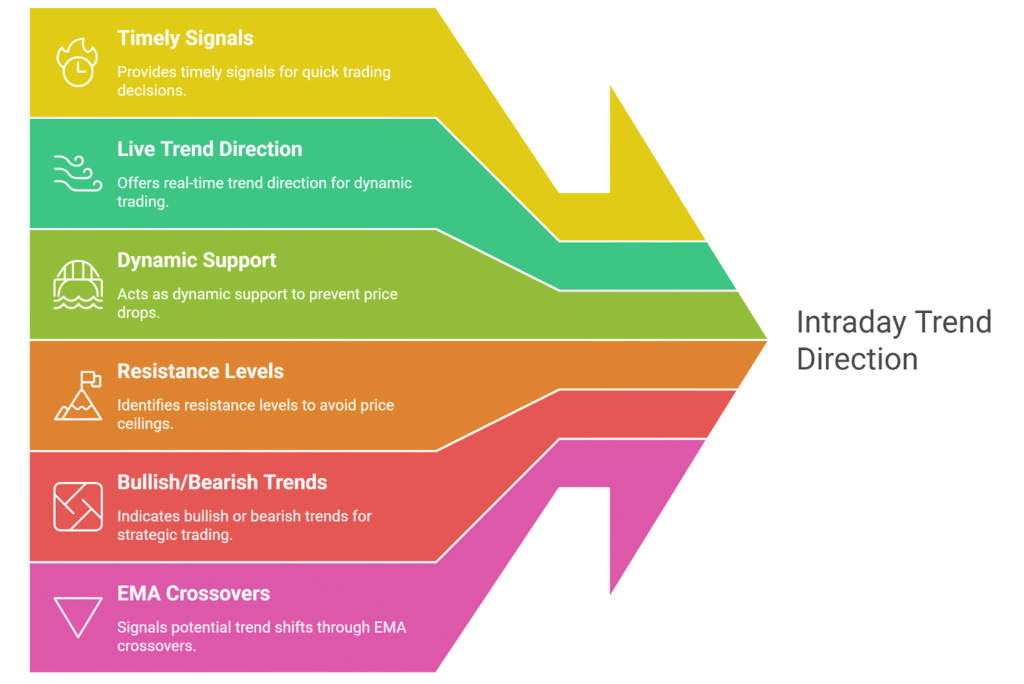

Exponential Moving Averages (EMAs) for Intraday Trend Direction

In day trading, traders are required to use Exponential Moving Averages for intraday trend direction, as these are more responsive to recent price movements as compared to the simple MAs. The EMAs help traders with:

- Timely signals

- Live trend direction

- Dynamic support

- Resistance levels

Additionally, traders primarily use short-term EMAs, such as the 20- and 50-period EMAs, to aid in determining trend direction and dynamic support and resistance levels. The EMA also indicates whether the market is in a bullish or bearish trend. If the price is above the EMA, the bullish moment takes over. Meanwhile, if it’s below the EMA, the bearish momentum prevails. Traders can also use EMA crossovers to identify potential shifts in trend.

RSI Levels That Actually Matter for Day Traders

In day trading, traders use the Relative Strength Index (RSI) to identify market trends, potential overbought and oversold conditions, and momentum shifts in the volatile trading market within short time frames of 5 to 15 minutes. Traders can also combine RSI with price structure or trend direction, as these help time entry and exit points accurately. When using RSI for day trading, it is better to use it with adjusted levels instead of the 30-70 level.

But if traders wish to use the 30-70 level, any readings above or below these levels should be used with caution, as they are not definite trend reversal signals. During a strong uptrend, RSI remains above 40 and retreats near 60 before the next high. The RSI struggles to rise above 40 during a downtrend and stays below 60. This approach allows traders to avoid making decisions against the main trend.

Using MACD to Time Intraday Trend Continuations and Reversals

When traders want to determine both trend direction and momentum simultaneously, they use the MACD. It helps traders identify trend continuation, particularly after pullbacks. For instance:

- A bullish crossover during an uptrend indicates trend continuation.

- A bearish crossover during a downtrend indicates fresh selling pressure.

Additionally, traders can also use the MACD histogram, which illustrates the momentum via the bars. For instance, shrinking bars signal waning momentum, while the expanding bars suggest strengthening momentum. Since MACD is a confirmation indicator, it is most effective when combined with price action and key levels, as this helps traders enhance their timing.

Volume-Based Indicators for Validating Breakouts and False Moves

In day trading, traders utilize volume-based indicators to accurately verify breakouts and false moves. It helps traders assess market participation behind price movements. When the volume signal rises, the breakouts are known to be reliable. If the volume declines, such breakouts usually are categorized as false moves and are more prone to failure.

To ensure the effective use of volume indicators, pair them with price action. This combination validates breakouts and trend continuations better. Most professional traders use some of these popular volume indicators:

- On-Balance Volume (OBV)

- Volume Weighted Average Price (VWAP)

- Volume Oscillators.

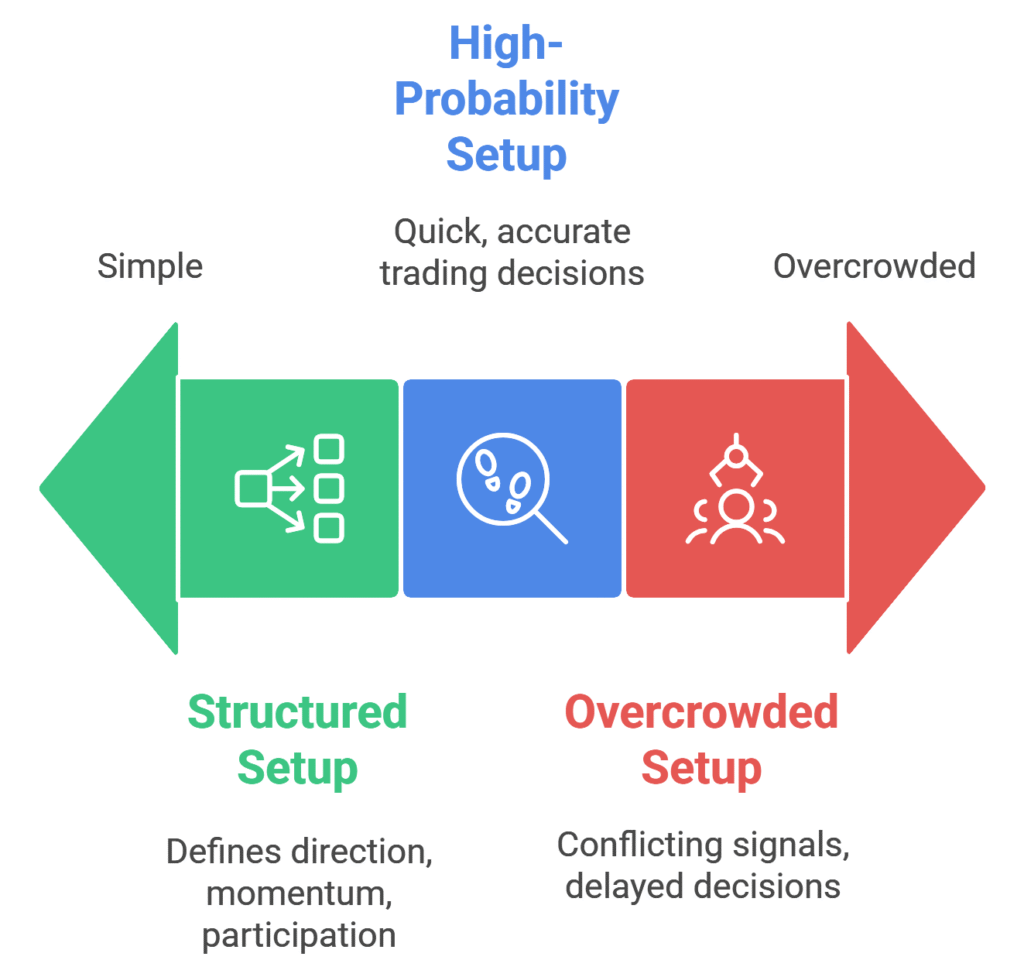

Building a High-Probability Indicator Setup Without Overcrowding Charts

For day trading, traders need to build a high-probability indicator setup that avoids overcrowding the chart, ensuring they can make quick and accurate trading decisions. For this, traders need both balance and selectivity. Traders can build a structured setup that involves a trend-following indicator used for defining:

- Market direction

- Momentum oscillators that determine strength and timing.

- Volume-based indicators to establish participation.

For instance:

- You can use a moving average to establish the intraday trend.

- With momentum oscillators like the RSI, MACD, etc., you can identify momentum shifts in the trend.

- By using a volume indicator, you can confirm if the market interest backs price moves.

When applying such indicators, traders must avoid overcrowding, as that could lead to conflicting signals and delayed decisions. With a simple chart setup, traders can enhance their focus, execution, and confidence throughout their day trading journey.