Have you ever come across a prop firm ad that is flashy and promises huge profits and payouts? And you might have planned to sign up with it. But here’s the catch, once you register and pay up an evaluation fee to get started, you will be met with complete silence. Not only that, you will earn zero profits, zero payouts and all of your hard earned money will be gone.

While it is true that the current rise in prop firms has brought countless opportunities for traders to begin their journey and trade with ease. However, in parallel, many traders have become victims of fraudulent prop firms disguised as genuine. Some of the most common complaints of these prop firms include unfair rules, zero transparency, and hidden costs.

If you are beginning your trading journey, it is essential for you to understand how genuine and credible prop firms operate and what they offer. This helps you in deciphering between genuine and outright scam firms. This article is an in-depth guide about prop firms that helps you learn:

- How the most reputable prop firms operate.

- What are red flags of fake prop firms?

- Do’s and don’ts of the most trusted prop firms.

How Legitimate Prop Firms Operate

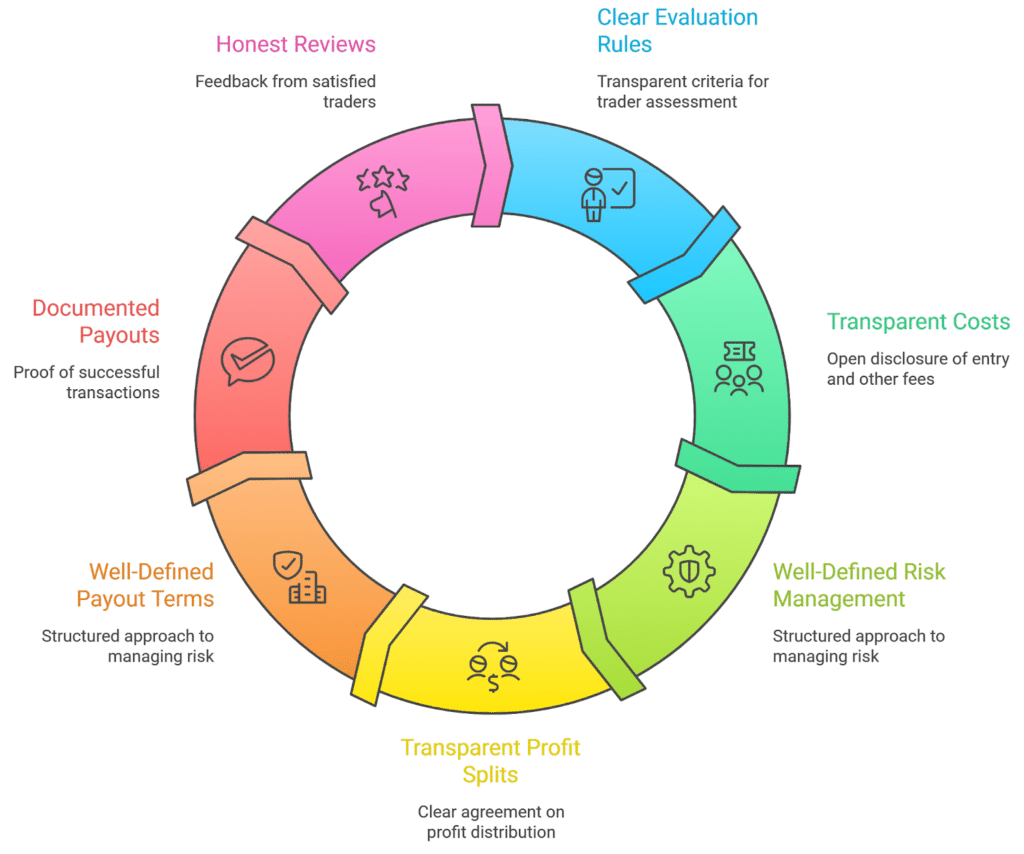

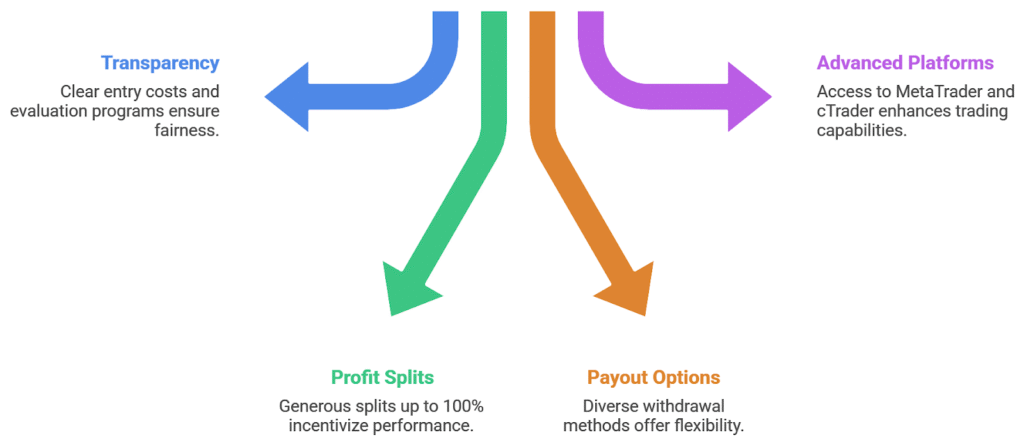

Trading with a legitimate prop firm is one of the best experiences for professional traders. With clear evaluation rules, transparent entry and other necessary costs, well-defined risk management rules, transparent profit splits, and well-defined payout and withdrawal terms, a legitimate prop firm offers it all.

Along with these, such firms always have been in the market for a few years. To help traders with verification, they also offer documented payouts and honest reviews by their global clientele.

To see what these prop firms bring to the table, let’s dive in.

Structured Evaluation and Funding Process

The main difference between a fraudulent prop firm and a reliable one is the difference in their structured evaluation and funding process. A structured prop firm runs on a structured evaluation process that mentions each step clearly. It will never promise you returns or huge profits. Rather, you are required to trade with discipline and within all rules, such as the profit targets and drawdown limits.

Once you successfully manage to bring in profit, you will be allowed to access your profits on the designated payout days. These prop firms offer multiple funding and withdrawal options. All information is available on their official website. Additionally, always remember, a successful prop firm will never change its rules in the middle of a challenge. If they do, you need to take a step back before incurring further losses.

Clear Risk Management Rules

When you trade with a trustworthy prop firm, you will notice that they have clear and well-established risk management rules. These include overall drawdown limits, daily drawdown limits, and acceptable position sizes based on account type. These limits are in place to ensure traders use the firm’s resources and capital responsibly and efficiently. So instead of reckless and irresponsible trading, traders trade with caution and discipline.

However, in case of violations, traders can lose or blow their trading account. The prop firms mention all these rules and guidelines on their official platform. Always read up on all the rules to see what you are signing up for and avoid confusion or inconveniences later on. These rules are set to protect both the firm’s and the traders’ time and resources.

Profit-Sharing and Payout Transparency

Most of the renowned prop firms ensure generous profit splits that are mutually beneficial for both parties. To view the profit split percentage, visit their official website. Usually, the profit splits are anywhere between 50 and 100 percent. If users manage to meet certain criteria, they can access 100% profits.

Additionally, to identify a solid prop firm from a scam one, verify their payout transparency. Many prop firms mention their payout structures and minimum payout limits on their official platform. The firms also mention their allowed withdrawal methods. Once a trader withdraws their profit, they get a timestamp and receipt of their payouts. If a firm lacks transparency in its profit sharing and payout structures, it could be predatory and might eat up your money.

Public Presence and Trader Support

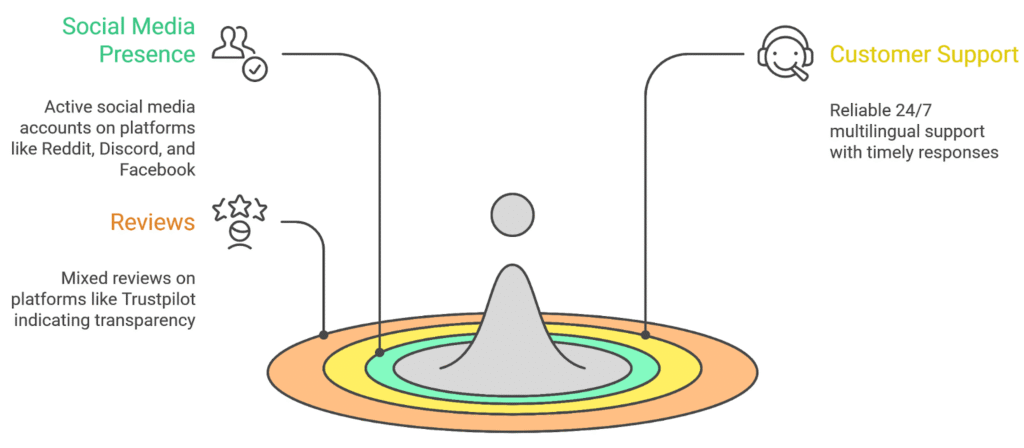

Before starting your trading journey, it is important to check the prop firm’s public presence and trader support. All legit prop firms have an active social media footprint that helps verify their genuineness. Many prop firms have forums and community groups on social media platforms like:

- Discord

Additionally, customer support is another one of the most important factors when you are deciding upon a prop firm. It can make or break your trading journey. Reliable customer support looks like this:

- 24/7 live customer support.

- Multilingual customer support.

- Quick and timely responses.

You can also do a thorough background check about a prop firm by reading their reviews on platforms such as Trustpilot. Always remember, a genuine prop firm could have mixed reviews, while a fake one could have all positive reviews. So always look for community transparency.

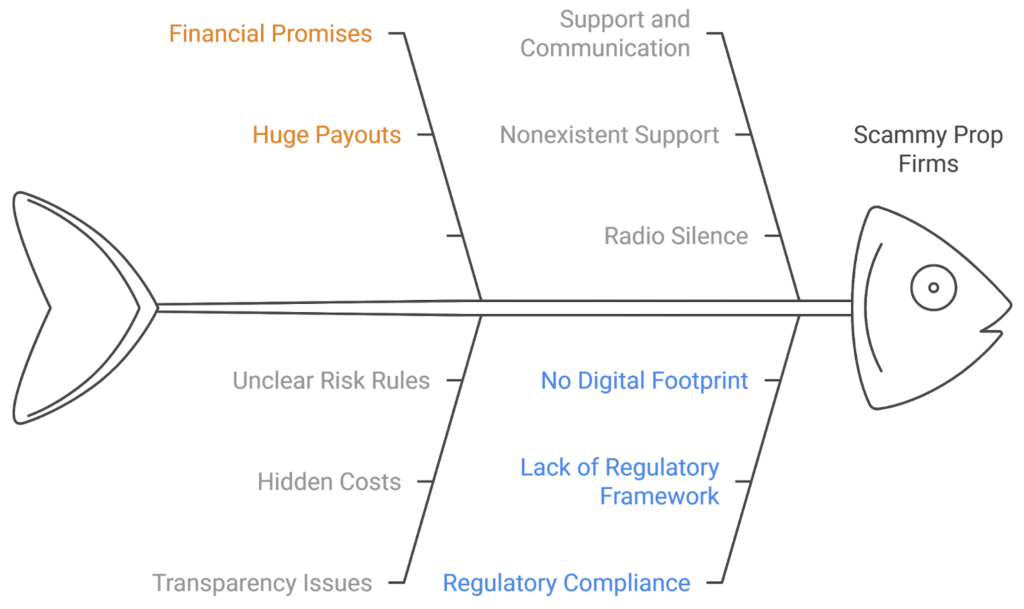

Common Red Flags of Fake Prop Firms

A scammy prop firm will always have some of these red flags. To identify one, watch out for these:

- It will promise huge payouts and profits with minimal risk.

- Lack of transparency about hidden costs and payouts.

- It will not mention risk rules and limits explicitly and overtly.

- There will be either zero or unrealistic trader payouts, which are unverifiable.

- Nonexistent customer support that is branded as 24/7 live.

- Upon queries, there are high chances of radio silence.

- Lack of regulatory framework and compliance.

- Lack of digital footprint and verifiable reviews from the trader community.

Always do your due diligence about a prop firm, and if a prop firm meets these red flags, proceed with caution.

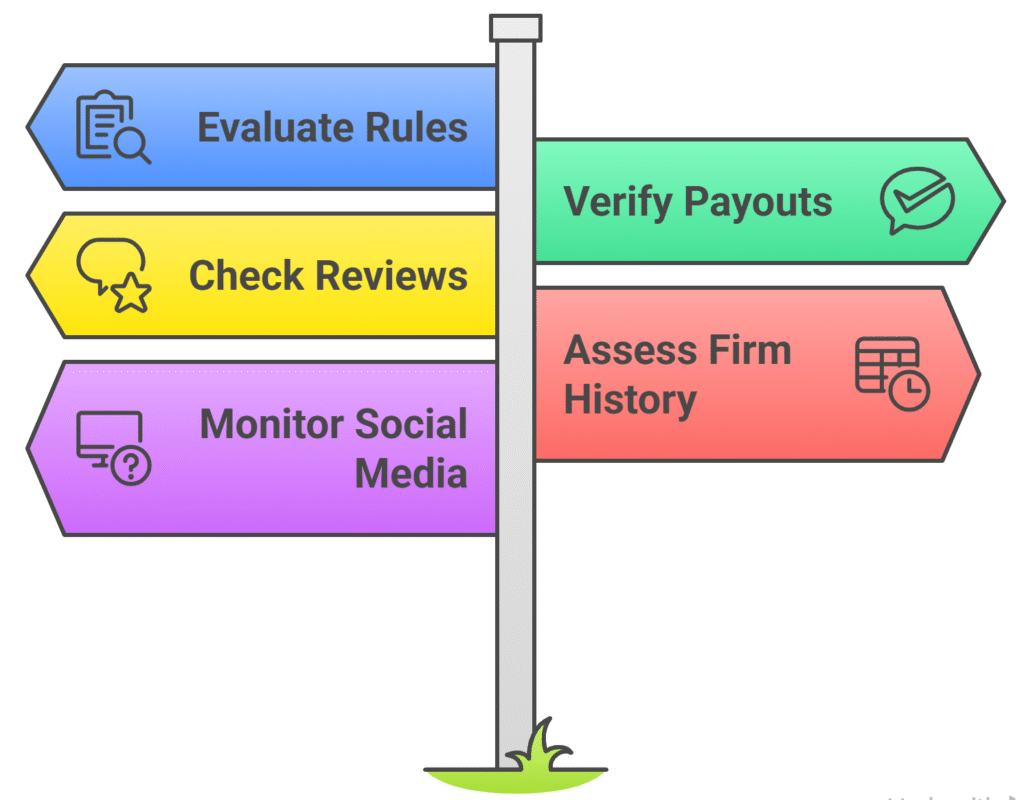

How to Identify Trusted and Reliable Prop Firms

Before starting your trading journey with any prop firm, look for these factors always found in trusted and reliable proprietary trading firms. These include:

- Read their evaluation rules and compare them with other notable firms’ evaluation rules for better clarity.

- See if their payout rules match with their customers’ testimonies.

- Look up the prop firm’s reviews and traders’ testimonies on other platforms.

- Check the firm’s lifetime, its regulation, and any controversy or disputes on the internet.

- Visit their social media groups, such as Discord or Reddit, and see the most common issues users had with the firm and how they were resolved.

All of these key points can help you gauge and assess if a prop firm is truly credible and trustworthy. A prop firm with good customer support, transparent rules and regulations, and good regulatory compliance is your best bet.

Reputable Prop Firm Example: The5ers

In the financial trading landscape, there are many prop firms that stand out. However, one of the best ones in today’s trading landscape is The5ers. It stands out because of its well-regulated and structured environment. The5ers started back in 2016. It offers sheer transparency in entry costs and evaluation programs. It has three evaluation programs, including:

- Bootcamp

- High stakes

- Hypergrowth

The5ers offers generous profit splits for its users, often ranging between 50 and 80% but can go up to 100% in some cases, provided traders meet certain conditions.

Additionally, it offers biweekly payouts. Traders can withdraw their profits using multiple options, including:

- Cryptocurrencies: USDT, Ethereum, etc.

- Bank Transfers.

Together with these benefits, The5ers also offer advanced platforms for traders such as MetaTrader 4, MetaTrader 5, and cTrader. With The5ers, traders can scale up to $4 million.

It is important to note that while The5ers is a reputable prop firm loved by millions of traders globally, it might not be your right choice. To see if it aligns with you, check your trading objectives and long-term vision. Before committing to any firm, always ensure whether a firm meets your criteria.

Ready to begin your trading journey? Join The5ers and enjoy trading with advanced trading tools, rewarding profit splits, and a promising scaling plan, and take the first step towards success.

Practical Tips to Avoid Prop Firm Scams

In 2026, the financial trading market is filled with countless proprietary firms. However, quality is never equal to quantity. To avoid prop firm scams and save your capital, follow these tips:

- Read all the risks and rules of the firms.

- Check their entry and other costs to avoid surprises later on.

- Visit the firm’s official page and other digital forums like Discord, Reddit, and Facebook to identify if their claims match the user’s experience.

- In case of any ambiguities, contact their customer support and check their response time and how they navigate issues.

- Check their profit split, payout frequency, and withdrawal limits to avoid future hassle.

In addition to these tips, always avoid firms that make unrealistic claims about huge profits and rewards, as these could be gimmicks to attract your investment. Such firms typically avoid responding and might vanish with your money later. Also, instead of relying on other users’ experiences and the firm’s claims, tune in to your intuition and see what works best for you.

Final Thoughts on Staying Safe in the Prop Firm Industry

The prosperity firms provide genuine opportunities for traders who are looking to start their journey or become professional traders. Usually beginners are unaware of their objectives and end up committing to prop firms that are fraudulent or even unsuitable for them. That is why it is always necessary to do complete due diligence and a background check about a prop firm before committing to it.

Any prop firm that makes flashy and huge promises, lacks transparency, and lacks a digital footprint is a no-go zone. Always remember reputable prop firms don’t need to make unrealistic claims; their performance and traders’ reviews do the talking for them. Growing with solid prop firms requires trading with calculated risk, patience, and discipline. If a firm is credible, has no loopholes, and meets your time commitment, risk appetite, and long-term goals, you may have found your best prop firm match.