Ever wondered how professional traders scale up successfully and grow their account size to 10x of what they initially started with? Well, turns out it’s an open secret. And the secret is compounding. Yes, you heard it right. You might have thought of compounding as a rigorous and gradual process that takes ages to work. However, this perception is not entirely accurate. While compounding takes some time to show for something, once your profits start accumulating together, each step builds up your rewarding returns.

Before diving deeper into how to compound properly, let’s look at what it means. Across trading, specifically personal trading, compounding refers to the process of growing your account size by continuously reinvesting the profits you make from your trades. So that means you can’t withdraw your gains if you want to compound. Over time, these profits build onto each other, subsequently growing your position size and your future trades’ profit potential. However, the process requires patience, discipline, and consistency to work. This article is a trader’s personal guide to starting compounding using their personal account. It helps you learn:

- Do’s and dont’s of compounding.

- Some risk management techniques for successful compounding.

- Challenges of compounding and how to navigate them.

What Does Compounding Mean in Trading?

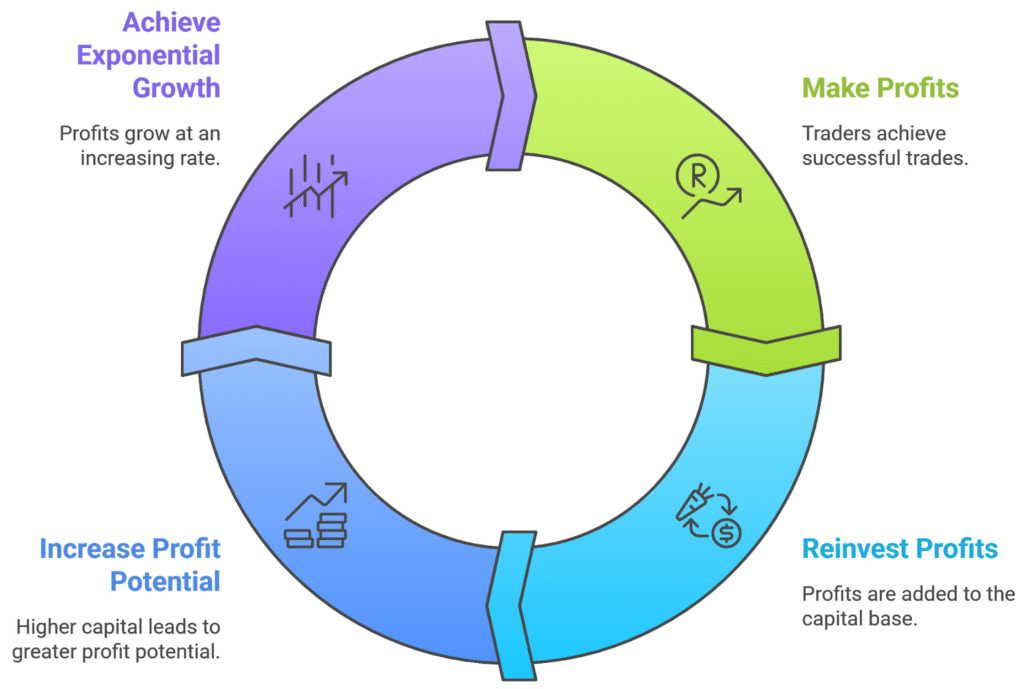

In trading, compounding is the practical application of exponential growth. To understand its meaning, let’s assume that when traders start their trading journey and make profits, they either have the option to withdraw them or to reinvest them into their upcoming trades.

If they reinvest them, their profit potential increases because this time they are making profits not only on their base capital but also on their previously generated profit. For instance, if you trade with a $10,000 account and your return is 5%, on your first trade it will be $500.

Instead of withdrawing your profit, you add it to your capital base; it will be $10,500. This trade will yield another 5% return equal to $525. Over multiple subsequent trades, your 5% returns will yield more profits, and they will grow at an exponential rate.

Even though compounding seems very easy on paper, it is easier said than done. It requires successful and regular profits along with solid risk management. Just like profits, losses can also compound over time if proper risk management is not applied.

How to Compound a Personal Trading Account

Compounding a personal trading account requires setting up clear objectives and figuring out long-term growth goals before committing to it. Traders need to determine what percentage of their profits will be reinvested and how position sizes will scale up accordingly. Risk tolerance is another factor that can make or break your compounding journey, so traders need to check it beforehand.

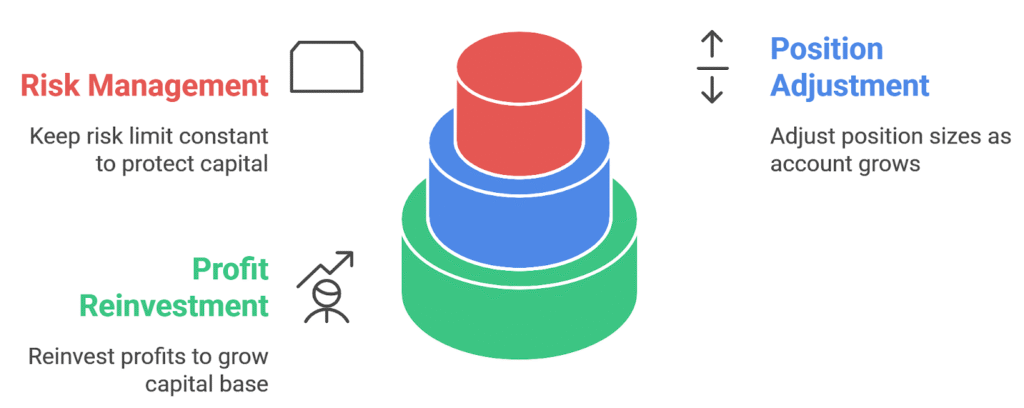

The first step to begin compounding is to invest the first profit you make into your capital base. Follow it up with continued reinvestment of the profits into the initial amount. This continuous reinvestment helps traders trade larger trade sizes and aim for bigger potential gains as your compounded amount grows. For successful compounding, reinvestment, adjusting position sizes, and risk management are the main tools.

Reinvesting Profits and Adjusting Position Size

For compounding to work, traders have to reinvest their profits and adjust their position size accordingly. Reinvesting profits is the central principle for compounding. Whatever profits traders earn, they reinvest them and grow their capital base with each reinvestment.

So for every subsequent base, their base capital is larger, and they can trade a larger size, which in turn increases the return amount size with each trade. To succeed with this strategy, begin by reinvesting somewhere between 70% and 100% of your profits either weekly or monthly. If you are a beginner or if your trading strategy is new, avoid investing all of your profits.

As your account size grows, you can adjust your position sizes accordingly. The key is to keep the risk limit the same instead of changing it with the larger account. For instance, if it was 1% or 2% before, it should remain the same when you trade with a larger amount. This limits your losses and protects your capital.

Risk Management for Sustainable Growth

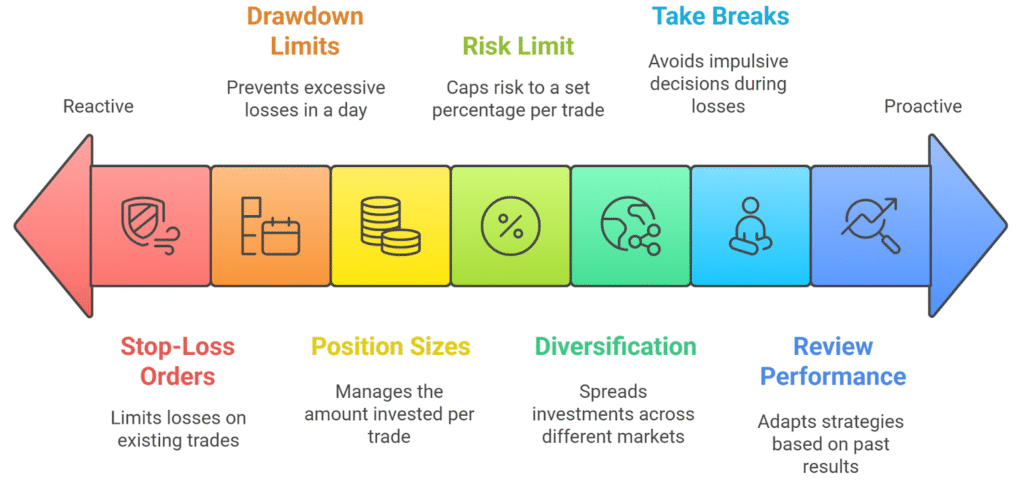

In compounding, risk management is another core factor that works to protect your gains and capital. With it, traders can grow sustainably and avoid huge losses or drawdowns that may eat up all of their savings. For proper risk management, skilled traders follow these rules:

- They begin by clearly defining their position sizes.

- They limit their maximum losses and daily drawdown limits.

- Following a fixed risk limit such as 1% or 2% per trade is another essential factor.

- They use stop-loss orders when necessary.

- They diversify their investments across multiple markets to reduce the risk of losing it all at one place.

- Taking breaks during a losing streak instead of impulsive trading or overtrading safeguards both their capital and their profits.

- They regularly review and revise their performance and align it with what works.

With these rules, traders ensure that if they lose, their losses are manageable and not too big. If these rules are properly applied and you show up regularly and avoid haste, you can scale up with confidence, and your compounding will be fruitful.

Challenges of Compounding a Personal Account

To compound a personal account over time consistently is doable. Yet, it can be very challenging. Despite the trader level, each trader has a different psychology, and everyone responds to challenges differently. For some, compounding might be simple and easy, but for others, it can be quite tricky. Here’s how:

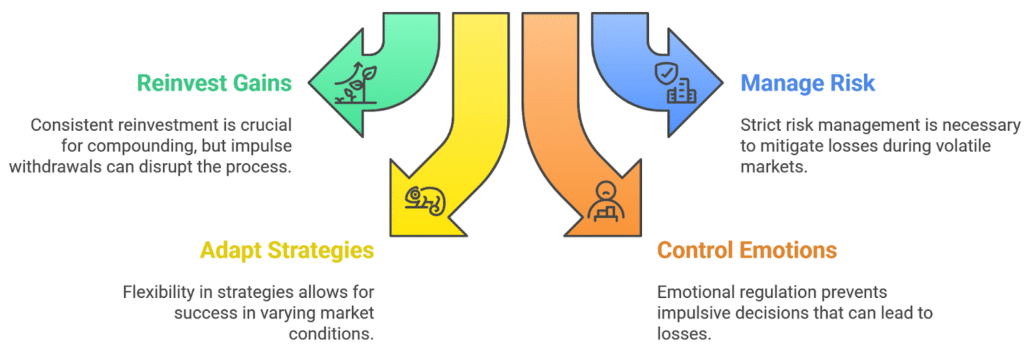

- To compound a personal account, traders must reinvest their gains over a period of time. However, some traders might decide to withdraw their profits out of impulse and break their compounding plan.

- Sometimes, the markets get really volatile, and traders end up crossing the drawdown limits. To combat that, traders need strict risk management in place since compounded accounts amplify not only profits but also losses.

- For effective and long-term compounding, traders need to be flexible with their strategies and be able to adapt to different trading conditions when needed. It is because one strategy might outshine in one trade, but for another trade, that strategy could land losses.

- Traders need to use well-defined entry and exit points and stop-loss orders. If the traders trade emotionally, the chances of losing their compounded gains increase.

All these factors illustrate the challenges traders could face while compounding their personal accounts. In trading, beyond numbers and strategies, psychological control and emotional regulation count as well. With poor psychological management, compounding in the long run is highly unlikely.

Using Prop Firm Profits to Compound a Personal Account

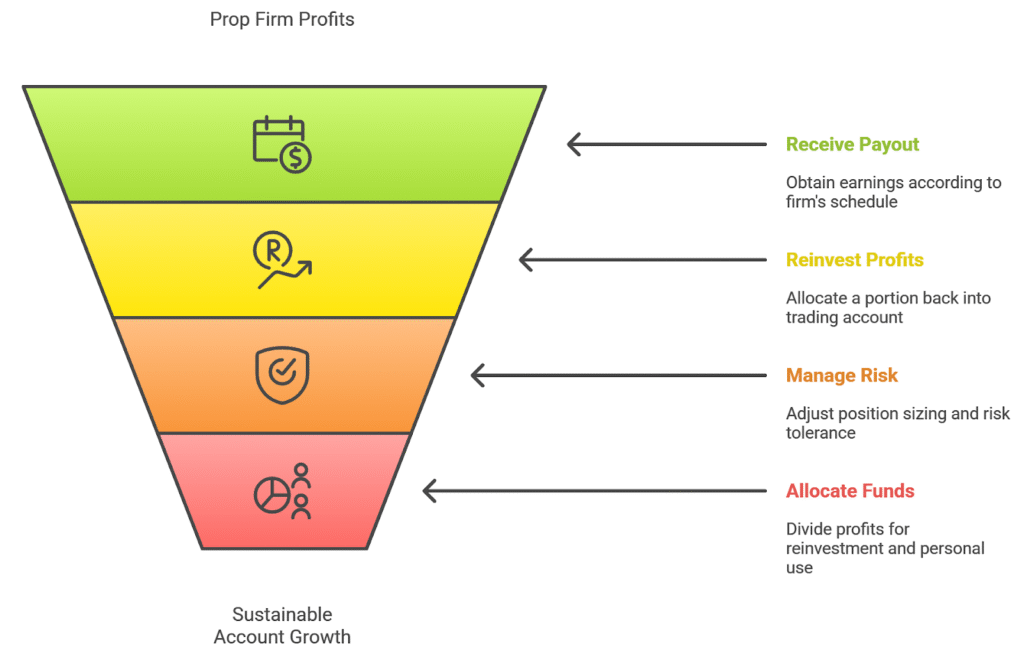

To compound a personal account using a prop firm is very easy. Most of the prop firms provide traders with scaling plans present in their trading program. Many prop firms allow traders to scale up from $2 to $4 million. For compounding successfully, traders are required to follow the firm’s payout schedule.

Each prop firm has a different payout schedule, such as biweekly or monthly, or even on demand. Once you get your payout, you can reinvest it back into your trading account. It is important to note that compounding with a prop firm could take time. Most firms prefer that traders grow sustainably instead of aggressive unstable growth.

The rules for compounding remain the same, including reinvestment, adjustable position sizing, risk tolerance, etc. Additionally, it is better to divide the profits into different sections. Allocate one portion for reinvestment. You can use the other portion for your personal liquidity needs and other trading costs. With a disciplined plan, you can compound using a prop firm in the long term hassle-free.

The5ers as a Prop Firm Option

The5ers is one of the best prop firms out there that stands out for its advanced trading tools and platform, multiple funding programs, flexible payouts, generous profit splits, multiple withdrawal options, and rewarding scaling plans. With The5ers, traders can compound their capital with the prop firm up to $4 million.

This plan allows traders to scale up with consistency and comfort. For instance, their bootcamp program allows traders to scale up 5% with every profit target they meet. Their profit splits are very generous and start from 50 to 80%, depending on the program, and can go up to 100%. Additionally, The5ers is known to offer flexible reading conditions to traders. It allows traders to trade across multiple asset classes as well.

How The5ers Scaling Model Supports Compounding

The5ers scaling model is designed to support compounding in the long-term for traders. Traders can choose from three models, including:

- Hypergrowth

- High stakes

- Bootcamp

Once traders can generate profits regularly and meet profit targets consistently, they can scale up. All models allow scaling up to $4 million. Additionally, as traders scale up, their profit splits also grow. All these factors contribute to successful compounding and allow traders to grow their account size significantly.

Ready to compound with your prop firm profits? Join The5ers and compound up to $4 million with confidence and zero hassle.

Best Practices for Long-Term Compounding Success

For long-term compounding success, reinvesting profits back is not the only thing.

It requires following a proper pathway with discipline, consistency, and patience. Otherwise, your long-term compounding might not yield the results you hoped for.

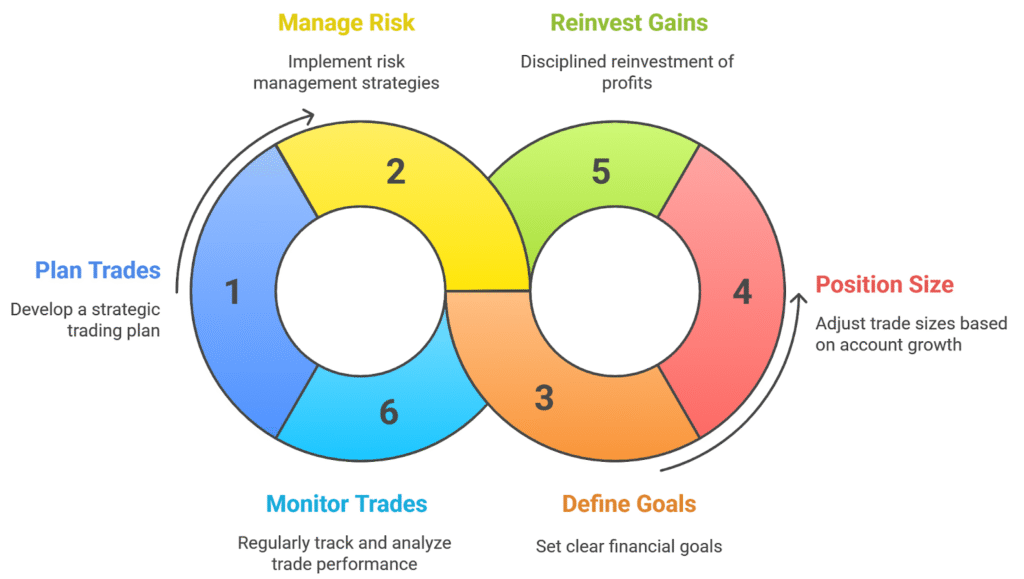

Strategic Planning, Proper Risk Management, and Disciplined Execution

To ensure a good compounding journey and solid yields, traders are required to strategically plan their trades with proper risk management and disciplined trading. Additionally, it is important to define your goals and risk tolerance. As your account size grows and your profits accumulate, position size your trades accurately.

Another important factor is reinvesting gains with discipline and avoiding impulsive withdrawals. For long-term success and growth, regularly monitor and track your trades and see what works and what doesn’t. All these factors combined together contribute towards a rewarding compounding success.

Conclusion

When traders begin trading to grow wealth and account size, it is essential to start compounding their profits. Compounding not only grows your profits but also grows your account size. This, in turn, yields better returns. Traders can choose to compound with a personal account, or they can also explore compounding their personal account using prop firm profits.

Regardless of the method, compounding can be quite challenging for some traders due to trader psychology and a elack of emotional regulation. For an efficient compounding experience, disciplined reinvestment, risk tolerance, and proper position sizing are the core factors. However, it is important to note that compounding is not an overnight process and requires patience, discipline, consistency, and commitment to yield returns.