When traders begin their trading journey, they often get confused about whether to trade with a broker or a prop firm. While both come with their own pros and cons, they are better suited to distinct trader types. Before delving deeper, let’s examine each to gain better clarity.

Trading with a broker involves using a licensed brokerage platform to buy/sell financial instruments, such as stocks, commodities, and indices, with your own capital. The broker provides you with access to the platform, order execution, and market access, while you are solely responsible for managing the profits, losses, and risk.

Meanwhile, prop firm trading involves trading financial instruments, such as forex, stocks, and crypto, using the firm’s capital once you have cleared the evaluation phase. In return, the profit you make gets split between both parties.

Whether you plan to start your trading journey with $100 or want to trade full-time, it is essential to understand the different routes both mediums take you through. This article is an in-depth guide that covers all fundamental information about both mediums. It helps you learn:

- How to trade with $100 using a broker and a prop firm.

- Some of the best brokers for different trader profiles.

- Risks, costs, and growth plans offered by brokers vs. prop firms.

Starting with $100: What a Broker Offers vs. What a Prop Firm Offers

Starting with only $100 can be quite tricky to navigate in the financial markets without a clear plan. Despite the challenges, both brokers and prop firms can help you get started with $100. Here’s what each offers.

| Type | Broker | Prop Firm |

| What $100 Does | Buy a cent/micro account and provide immediate market access. | Buys an evaluation/challenge phase. |

| Account Funds | Traders’ own funds. | Once the evaluation is passed, the firm provides the funds. |

| Profit | The trader keeps the profits. | Profits get split between the firm and the trader. |

| Requirements | After account setup, complete KYC and follow margin rules. | Meet profit targets and stay within drawdown limits, and follow trading rules. |

| Scaling Potential | Gradually, it could increase with consistent compounding. | Quick, with access to larger accounts with scaling plans. |

| Example | Exness, FBS, etc. | The5%ers, FundingPips, etc. |

$100 With a Broker: Account Types, Growth, and Costs

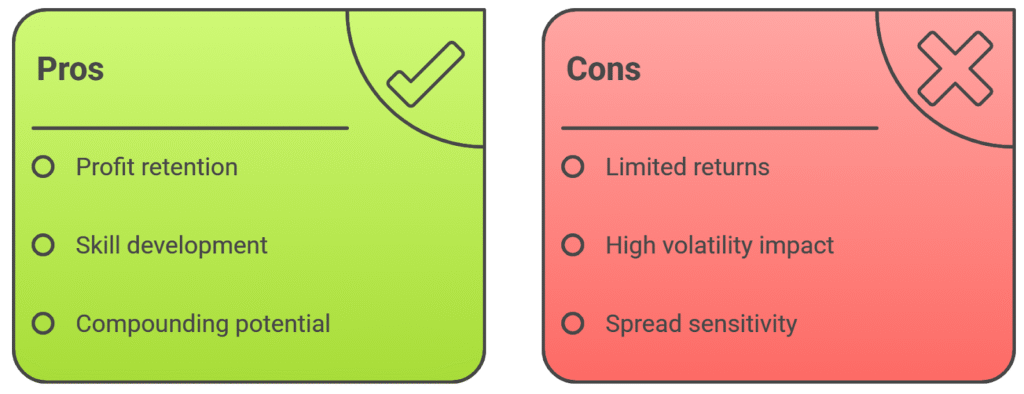

To begin your trading journey with $100 through a broker, you need sharp focus and disciplined risk management. Once you gain access to the market, you can select your preferred account type. Since the account sizes are small, factors such as spreads, leverage, and market volatility are significant.

The best part about trading with a broker is the freedom to retain all the profits for yourself. However, a $100 account can only help you learn better execution, refine your strategies, and develop risk management skills. So don’t turn to it to make aggressive returns. If you wish to trade with it consistently, you can grow it through regular compounding.

Account Types

A broker usually offers these account types for a $100 deposit:

- Cents

- Micro

- Standard

- Demo

With such a small amount, your best bet is a cents account. It works best because the broker converts your $100 into 10,000 units, which helps you trade in small lot sizes.

Another benefit of a cents account is that you can sustain it during high price fluctuations without fearing immediate liquidation.

As a beginner, you can join FBS, Exness, and similar platforms that offer small account types with low deposits and allow flexible position sizing. A $100 account is ideal for getting started in trading efficiently with minimal risk.

Costs

One of the main concerns during the trading journey is the trading costs. In a $100 trade, there are several costs, including spreads, swaps, and commissions. Sometimes, during the journey, traders may encounter hidden or unexpected costs, including withdrawal and inactivity fees.

You must manage these costs effectively, as they could reduce your overall net profit in a $100 account. This makes it crucial for you to select a broker that offers tight spreads, low commissions, and maintains complete fee and pricing transparency.

Growth Limits

Although a $100 broker account may seem small and unpromising, if approached the right way, it could yield better long-term gains. But to materialize that, you need long-term, consistent compounding or high-risk exposure. These factors make such small accounts risky in terms of their growth potential.

Additionally, you need to follow strict position sizing and maintain a high win rate to sustain your account. So avoiding large drawdowns is a must. Additionally, managing such accounts can be mentally taxing due to the time commitment and risk involved, so never consider them the fastest route to success in trading.

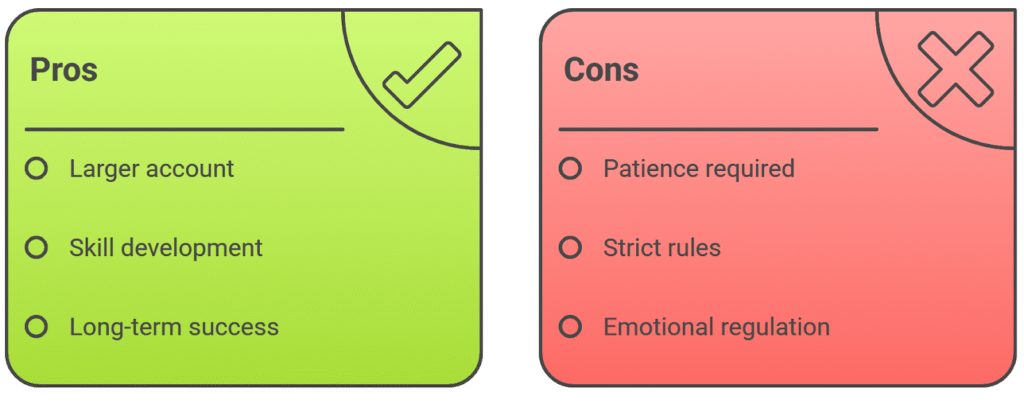

$100 with a Prop Firm: Funding Models, Fees, and Scaling Potential

If you prefer a prop firm environment over a broker, then starting your prop firm journey with $100 requires a little patience. With $100, you can purchase a challenge or evaluation phase. Once you clear that, the prop firm could provide you with a larger account with the firm’s funds.

However, to qualify for prop firm trading, you need skill, determination, and good emotional regulation to withstand the challenges that come with it. Additionally, following strict risk management rules, adhering to strict drawdown limits, and consistently demonstrating discipline can help you succeed in the long term.

Funding Models

Many prop firms offer multiple funding models for beginners and traders of all levels alike. The most basic funding model involves the evaluation and challenge phases, where traders undergo a test of their skills and discipline. Once traders meet all profit targets and other limits, they get funded to begin their trading journey.

Firms like The5%ers also provide such models for beginners. For instance, The5%ers bootcamp model requires you to pay only $95 for a $25k account. However, it requires traders to prove their commitment and discipline to qualify for the account.

Fees

With $100, it is possible to trade with prop firms. The entry cost depends on the challenge traders choose. Some firms, like the Goat Funded Trader, FundedNext, and The5%ers, charge under $50 for a $5k account. All these programs fall into the beginner bootcamp category.

Once you start trading with a firm, your profit is usually split 50-80%. However, it comes with a catch: if you fail a challenge, you may have to repurchase it until you clear it. It is essential to read the firm’s policies regarding fee structures and refund rules before purchasing any program to avoid any issues later on.

Scaling Potential

The best thing about prop firms is that, with $100, traders can access larger capital and resources from the firm and scale up to even higher amounts. While prop firms promise a scale-up faster than what compounding could offer, traders must follow these to scale up successfully:

- Follow all risks and rules.

- Stay disciplined and consistent.

- Avoid crossing drawdown limits.

The5%ers Overview: Funding Programs, Scaling Plan, and Payout Structure

The5%ers is one of the best prop firms out there, providing traders with access to the firm’s capital once they have passed the designed programs. Its entry costs are low, and profit splits are generous, potentially reaching up to 100% if certain conditions are met. Meanwhile, traders can scale up to $400,000 with The5%ers.

Ready to start trading with The5ers? Start your evaluation now and receive a 10% discount, taking the first step towards trading growth and success.

Funding Programs, Scaling Plans, and Payout Structure

At The5ers, traders can select from multiple funding programs tailored to their experience and objectives. Some of these include:

- Bootcamp: pass demo phases to access a live account.

- Instant-Funded/Hyper-Growth: has a one-step entry level before access to immediate resources.

- High-Stakes: involves a two-step phase designed for advanced traders seeking higher leverage and rapid growth.

To scale up with The5%ers, traders are required to join the scale-on-profit model. In this, traders meet specific profit targets and continue to advance further. The maximum scale-up limit is $4 million.

Their payout structure follows a bi-weekly plan for profitable and consistent traders. It becomes activated 14 days after funding.

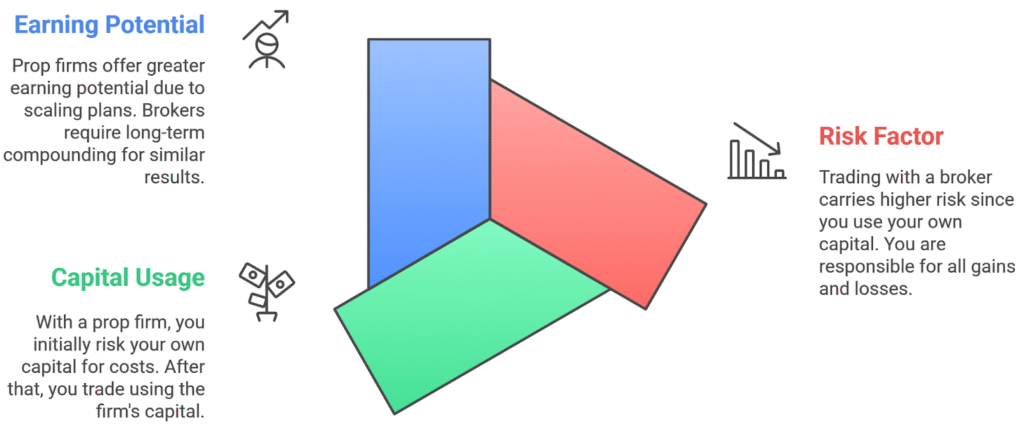

Broker vs. Prop Firms: Risk, Capital Access, and Earning Potential

The risk factor for trading with a broker is higher than that with a prop firm. With a broker, you trade using your own capital. Whether you lose or make gains, you hold the responsibility. With a prop firm, you risk your own capital only in the beginning for initial costs, so you trade using the firm’s capital.

Due to the distinct model types, your earning potential is greater with a prop firm, thanks to its scaling plans. Whereas with a broker, you would require long-term compounding.

Best Brokers for Small Accounts and Full-Time Traders

If you are starting, you need a broker with tight spreads, low commissions, and flexible position sizing. This helps traders experience live trading with low risk, allowing them to learn and grow gradually. Additionally, quick and timely payouts, advanced platforms like MT4 and MT5, and flexible leverage make it an ideal broker for beginners.

Some of these include:

- FBS

- Exness

- XM

Whereas, if you are looking to trade full-time, you need a broker with slightly advanced tools such as low-latency execution, solid liquidity, deep margin, and transparent fees and pricing structures. ECN/STP-enabled brokers are your best bet for full-time trading. For instance:

- Exness

- Pepperstone

- IC Markets

Depending on your preferences, it is best to conduct thorough research and find a broker that meets your requirements for achieving trading success.

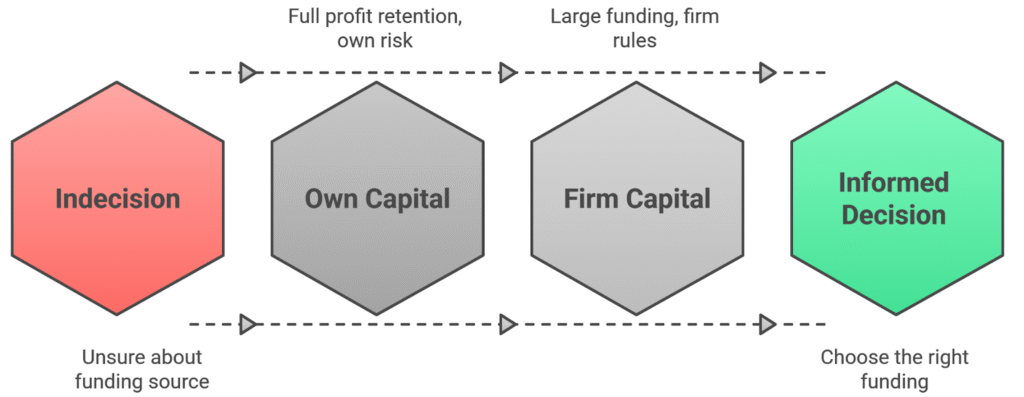

Full-Time Trading: Using Your Own Capital vs. Trading Firm Capital

If you are looking to trade full-time but can’t figure out whether to trade with your funds or with a firm’s funds, look at these differences below to decide your right choice.

When you trade using your capital:

- You receive variable income and can retain your profits in full.

- Broker selection and handling selection become your own responsibility.

- You manage risk management yourself.

On the other hand, when you trade using a trading firm’s capital:

- You receive a substantial funding sum with lower entry costs.

- You receive profits and payouts on time, especially in high-tier accounts.

- You follow firm rules and trading limits to sustain your account.

- It provides rapid scaling up and account growth.

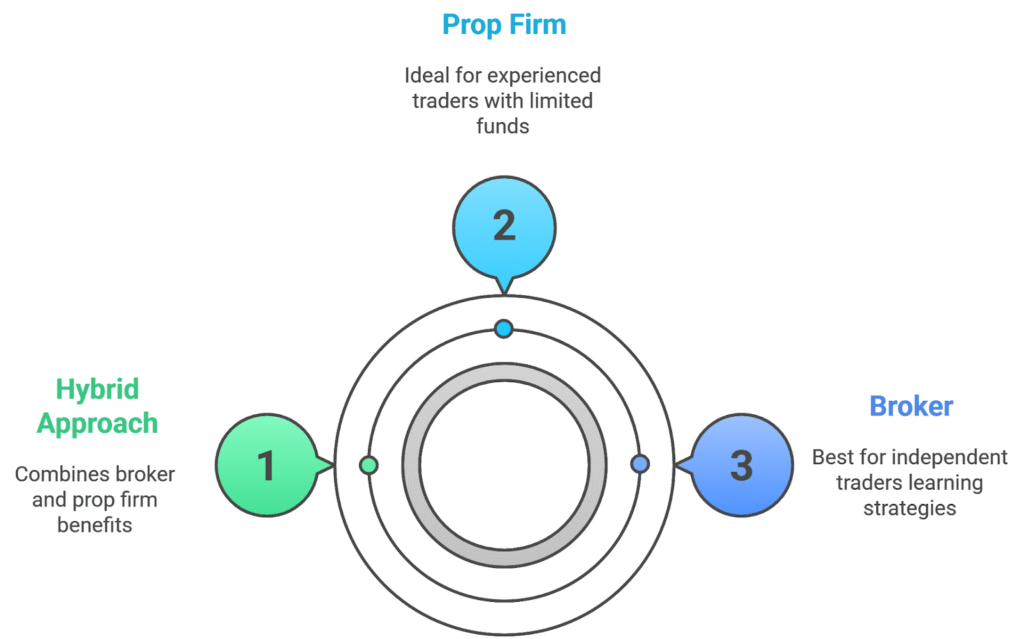

Decision Guide: Who Should Choose a Broker, Who Should Choose a Prop Firm

When choosing between a broker and a prop firm, several factors come into play. If you prefer to stay in control, trade without external pressure and trade at your own pace, then a broker could work best for you. It also helps you test and refine strategies, learn and develop risk management rules, and grow gradually. However, it also comes with high personal risk, so if you are good with that, it’s your best choice.

A prop firm is best suited for traders who have developed expertise and skill over time in the market and are confident about their edge. Additionally, in case of limited funds, it’s your best ally. However, it requires meeting profit targets and trading within established limits while adhering to the firm’s rules. The profit is divided between the firm and you in return. It’s ideal for full-time traders seeking a diversified income and accelerated growth.

For some traders, a hybrid approach may be the best option, as it allows them to learn and execute various strategies with a broker account before transitioning to a prop firm account to maximise profitability.

FAQs

As a beginner, should I trade with a prop firm or a broker?

If you are a beginner, it is better to start trading with a broker so that you earn and develop skills first to survive the market and understand how it operates. You can also combine both mediums if you prefer.

Does The5%ers have any educational resources to help traders learn trading?

Yes, you can visit their official platform and visit their blog and The5%ers academy to learn some tips and tricks and stay updated with market trends.

How much can I scale up with The5%ers bootcamp program?

If you trade with The5%ers bootcamp program, you can scale up 5% with every profit target you meet.

What is the difference in the scaling potential between prop firms and a broker? Which is higher?

If you want immediate rapid capital growth, prop firms are your best bet. With brokers, you can grow, but it requires more personal capital for expansion and long-term consistent compounding.

What is the success rate between prop firms and brokers?

Statistically, the success rate for prop firms is generally lower, as many traders end up blowing their accounts in later stages due to violations. However, it all boils down to a trader’s competence, discipline, patience, and consistency. With these metrics, long-term growth and success with both mediums is possible.

Conclusion: Selecting the Optimal Path for Long-Term Growth

Regardless of your trading level, it is essential to align your trading ally, be it a prop firm or a broker, with your time commitment, risk appetite, and long-term objectives. While broker trading is suitable for beginners and those seeking to develop their skills, it can be financially taxing. Meanwhile, a prop firm suits skilled traders who can prove their expertise and generate profits using their skills.

However, it comes with its own set of challenges, including meeting profit targets, and may not suit all traders. This is why you should always conduct thorough research before committing to any model. Whatever path you take, for optimal success, consistency, discipline, and patience are your best friends.