Starting Forex trading is one of the trickiest things to do, but it is also one of the most lucrative options for those seeking financial stability. While professionals become proficient over time, beginners struggle as they delve into it without a structured plan. They assume that winning and failing enough times will help them adapt. However, the truth is much simpler: zero risk management, impulsive trading, and overleveraging are the primary reasons why beginners fail.

If you’re a beginner who has zero knowledge about how the ever-evolving forex market works, this article is for you. This article helps you learn:

- How to operate each step of forex trading.

- You learn how to operate AI to enhance your trading performance.

- How to develop a disciplined routine and master trading psychology.

Understanding the Forex Market

Before delving deeper, it is essential to understand what the foreign exchange (forex) market is and how it operates. This basic knowledge can help you get proficient in all the market fundamentals.

What is Forex Trading?

The foreign exchange market, also known as the forex market, is a decentralised system where financial institutions, banks, and individuals exchange currencies globally. The traders speculate on the price movements of the currency pairs and profit from the resulting price variations caused by natural events. Economic and global events influence market trends. It stays active five days a week and 24 hours a day. The forex market offers all currency pairs, including major, minor, and exotic pairs.

Key Terms Every Beginner Must Know (pips, lot, leverage, margin)

The foreign exchange market operates with several basic elements. These include:

| Type | Pip | Lot | Leverage | Margin |

| Definition | The smallest unit of price movement in a currency pair. | Refers to the trade size. | Used to control prominent positions with a relatively small amount. | Amount paid to sustain the leveraged position. |

| For example | If EUR/USD moves from 1.1050 to 1.1051, then the slight change of 0.0001 is a pip. | A standard lot equals 100,000 units of your base currency, so if you trade EUR/USD, you control €100,000. | You deposit $100 to hold a position of $10,000, known as 1:100 leverage. | A $100 margin is required to open a $10,000 position. |

How the Forex Market Works (sessions, liquidity, major vs. minor pairs)

The forex market has three global trading sessions, which include Tokyo, London, and New York. While the market operates 24/5, liquidity is the highest when the sessions overlap. This leads to tighter spreads and seamless order execution. Additionally, forex has major pairs and minor pairs.

| Type | Major Pairs | Minor Pairs |

| Definition | Highly traded pairs, offering high liquidity and tight spreads. | All major currencies except USD. It offers wide spreads, but low liquidity. |

| Example | EUR/USD, GBP/USD, and USD/JPY. | EUR/GBP, GBP/JPY, and AUD/NZD. |

Building the Beginner’s Learning Pathway

A structured roadmap that covers everything, from basic theory to live trading experience, makes your trading journey easy. The key is to start small with demo accounts and continue honing your skills until you are ready to apply them in the real trading market.

Each stage targets a specific market segment, encompassing strategy, psychology, and scaling. By following this guide, you can turn into a disciplined and consistent trader.

Stage 1 – (theory + market basics)

Stage 1 covers all the market basics and theory necessary for building the foundation needed to trade live. For beginners, a simple understanding of pips, lots, leverage, margin, and currency pairs is vital. Next up is the study of the behaviour of economic indicators, central bank policies, and global events. Once you understand these, you learn how these influence the market and when to make calls.

Additionally, this stage requires you to stay updated with reliable educational sources, such as academic journals, books, or reputable online blogs, to remain informed about the latest market developments.

Stage 2 – Demo Account Practice (30-60 day plan)

Once you have understood the basics, the next step is to open a demo trading account with your preferred broker, ideally a credible one, to start demo trading. For demo trading, traders use virtual funds. Your task is to practice trading for 30-60 days to explore order types, charting tools, indicators, and market analysis in a simulated environment.

This hands-on experience ensures you become well-versed with all the necessary tools and platforms required for satisfactory execution and performance. Lastly, it helps you identify your shortcomings and strengths, which in turn enables you to understand your trading preferences.

Stage 3 – Developing a Trading Strategy

This step involves developing a solid trading strategy that determines entry and exit points, as well as risk parameters. For instance, you can start by selecting your trading style, such as scalping or day trading. Then combine both fundamental and technical analysis to take a calculated risk. Additionally, backtesting strategies on historical data before implementing them live makes a significant difference. For further improvement, keep a trade journal that records your patterns and your strong and weak points. For sustained trading growth, having a well-tested and well-defined trading strategy is crucial.

Stage 4 – Risk Management and Psychology Trading

In the trading journey, effective risk management and emotional discipline occupy a significant space. Follow these key factors to stay on top of your game

- Limit your risk exposure to only 1-2% of the total capital per trade.

- Follow a consistent risk-to-reward ratio, somewhere around 1:2.

- Use stop-loss orders to limit unnecessary losses.

- Keep your emotions in check to avoid revenge trading to cope.

Consistency and emotional resilience are crucial when trading forex, as they are essential for long-term growth and success.

Stage 5 – Transitioning from Demo to Live Trading

Once you have successfully aced the demo trading, shift to live trading, but start with a small account that offers micro-lot positions. It is essential to begin your trading journey with discipline and effective risk management. Regularly track your trading performance and steadily increase the lot size to sustain your account in the real world. With this approach, you can grow your gains over time.

Stage 6 – Scaling and Advanced Learning

Once your trading feels steady and stable, start scaling for long-term growth.

- Avoid scaling up immediately.

- Start slowly and maintain effective risk control.

- Learn advanced strategies like portfolio diversification to avoid losing from a single place.

- Stay updated with the market through webinars and trading communities.

Staying flexible and well-informed is vital to adapt your style and strategies during different times. By following these steps, you can achieve a rewarding, long-term success in forex.

Essential Tools and Resources

To succeed in the forex market, having essential tools and advanced resources for market analysis and efficient trading is crucial. These include trading platforms, economic calendars, and risk calculators.

Trading platforms (MT4, MT5, TradingView)

In 2025, advanced trading platforms such as MetaTrader 4, MetaTrader 5, and TradingView are used for smooth trade execution and technical analysis.

- MT4 stands out for its simplicity and expert advisor support.

- MT5 is known for its multi-asset capabilities and advanced tools.

- TradingView provides powerful web-based charting and customizable

indicators.

Together, these tools enable traders to trade effectively across multiple devices with real-time access to data.

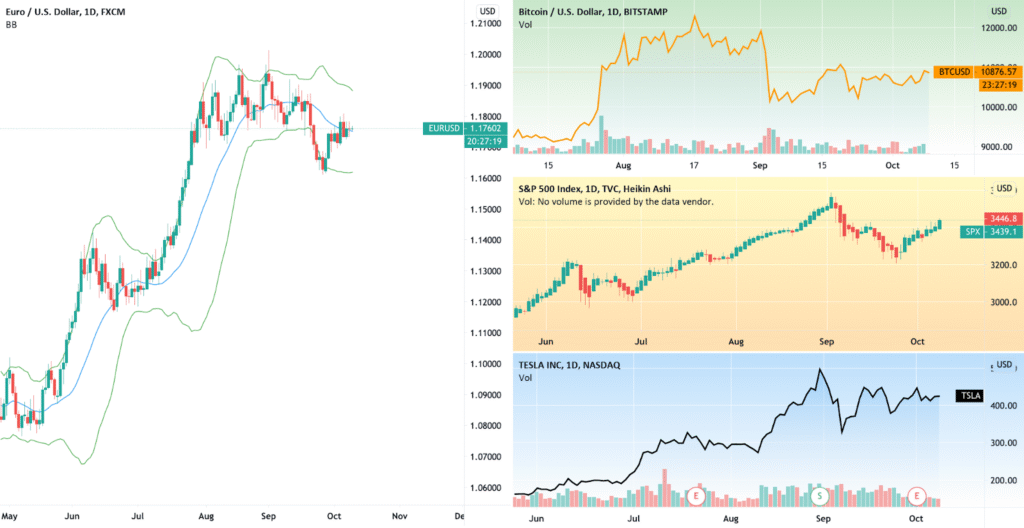

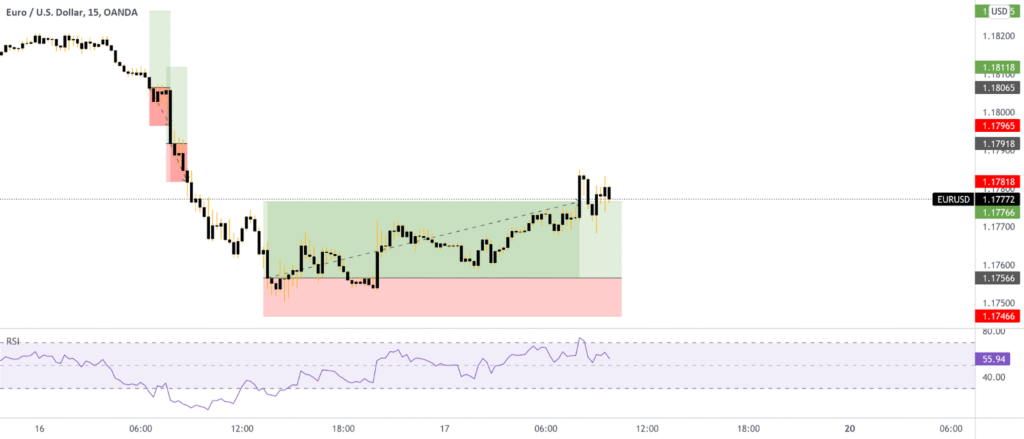

Charting and Analysis Tools

Trading requires you to speculate on price movements to identify any profitable opportunities. This is done with charting and analysis tools. On many platforms, like TradingView, MetaTrader, and cTrader, you can access built-in indicators, drawing tools, and customizable charts.

Additionally, for trend analysis, you can use technical indicators like

- Moving averages

- Relative Strength Index

To ensure you take well-informed risks and decisions, combine technical and fundamental analysis. Using reliable charting tools ensures that you can recognise trading patterns, backtest strategies, and enhance your trade execution.

Economic Calendars and News Feeds

To stay informed about events such as central bank policies, interest rates, and inflation data, economic calendars and news feeds are utilised. Some of the credible sources are

- ForexFactory

- Investing.com

- DailyFX

With these, you gain knowledge about the impact of volatility, event timing, and expected outcomes, preparing you for potential price swings. It is essential to stay informed about economic events to adjust your risk appetite and execute trades efficiently.

Trading Journal Templates and Risk Calculators

One effective way to improve trading performance is to maintain a trading journal that tracks your patterns and mistakes. For instance, you can use Excel, a reliable tool for monitoring performance.

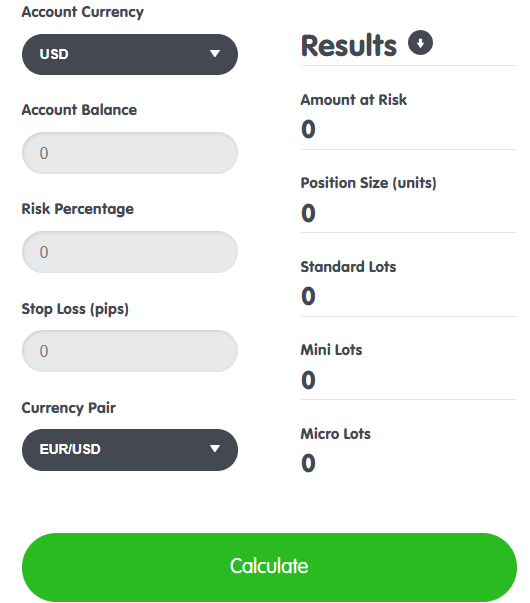

On the other hand, you can use risk calculators to identify appropriate position sizes, margin use, and any potential losses before placing your trades. A typical example is the Forex21 risk calculator.

With both of these tools, you can ensure consistency, accountability, and improved decision-making in our trading performance.

Practical Labs for Beginner Forex Traders

Practical labs give you the option to apply the trading theories using a real-market simulation. For instance, you can place trades on demo accounts, test strategies, analyse price charts, and practice risk management. This experience as a beginner enhances your decision-making skills and bridges the gap between theory and real-world experience, leading to a deeper understanding.

Lab 1- Setting Up MT5/TradingView Workspace

To set up MT5 or TradingView workspaces, download MT5 or sign up on TradingView. For MT5:

- Open your demo account.

- Log in with your broker’s credentials.

- Add major currency pairs.

- Set up chart types.

- Apply RSI or moving averages.

In TradingView:

- Create your watchlist.

- Set alerts.

- Customise layouts with tools of your choice.

With an organised workspace, it is easy for you to manage trades efficiently across multiple timeframes.

Lab 2- Placing Your First Demo Trade

To place your first trade:

- Select a currency pair like GBP/USD.

- Analyse the chart.

- Choose to buy or sell.

- Enter your position size.

- Set stop-loss and take-profit orders.

Once you confirm your order and check the progress in the terminal, by practising with demo trades, you can understand both pressure and risk without risking any real capital.

Lab 3- Building a Simple Backtest (step-by-step)

To build a backtest:

- Open the historical chart on your preferred platform.

- Identify your strategy, such as day trading or scalping.

- After entering the trade, go through the past data and choose the trade entry and exit points.

- Once done, record results either manually or through the platform.

- Lastly, review the win rate and drawdown.

Backtesting enables you to assess the potential of a strategy under various market conditions, allowing you to be confident and accurate in your approach before trading live.

Risk management and trading psychology

For a promising trading experience, risk management and trading psychology are essential factors. As a beginner, these require you to follow effective position sizing, manage emotions, and develop a consistent trading routine.

Position Sizing and Stop Loss Rules

Position sizing refers to the amount of capital you should risk per trade. Typically, a trader’s position size is 1-2% of their account balance. Meanwhile, stop-loss orders are used to limit your losses promptly if a trade moves against you. These factors ensure you avoid overexposure and protect your capital.

Risk-Reward Ratio and Expectancy

Risk-reward ratio and expectancy are vital for managing losses and measuring gains.

- To offset potential losses with profits, use a stable risk-to-reward ratio, such as 1:2.

- Use expectancy to measure your average profit or loss on each trade over time.

These factors help beginners achieve long-term profits by prioritising quality over quantity.

Common Psychological Traps (fear, greed, revenge trading)

When the market is volatile or traders experience losses, they are often vulnerable to emotional traps, such as fear, greed, and revenge trading, which can exacerbate the losses. If you engage in revenge or impulsive trading, you could end up digging a deeper pit of losses for yourself. When trading, it is essential to recognise these behaviours and emotionally regulate yourself through journaling and mindfulness to ensure that you lead your trades with logic, patience, and calmness.

Developing a Consistent Trading Routine

For focus and discipline during trading, beginners require a consistent routine.

- Start by trading for fixed hours.

- Stay updated with news events and analysis.

- Try journaling daily.

Having a proper routine helps with accountability and confidence. Once consistent, you can achieve stable and steady performance and improve for the better.

Using AI and LLMs to Accelerate Learning

Recently, both AI and Large Language Models (LLMs) have changed the forex trading landscape for beginners. Beginners receive everything they need instantly, including help in understanding the market and instant feedback.

Additionally, there are platforms with built-in AI systems that can analyse charts and simulate real trading environments. These tools help learners accomplish everything quickly, whether it’s identifying and correcting their mistakes or gaining real trading experience. Thanks to AI, forex education has become more data-driven and interactive for everyone.

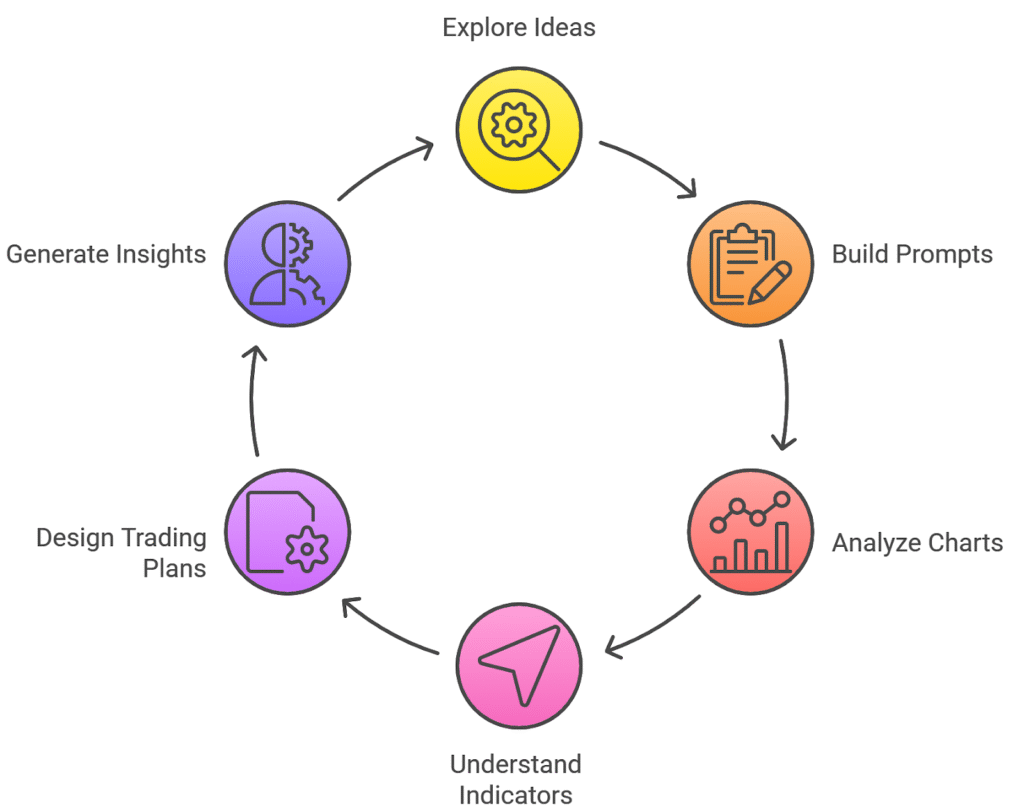

Prompt Library for Learning

A prompt library helps you use the ChatGPT productively to gain a better understanding of forex. There are options where you can build your own prompt library by exploring different ideas on ChatGPT. You can use prompts for various purposes, such as learning and analyzing charts, understanding indicators, and designing your personalized trading plans. The prompt library is time-efficient and helps you improve your knowledge with tailored insights, eliminating repetitions and vague statements.

For instance, if you ask ChatGPT to analyse a market like GBP/USD. It will identify the price drivers, economic events, and risk sentiment shaping the currency movement. This will save you the hassle of scanning multiple sources individually, and you will have updated information in one place.

Validating AI-generated Strategies with Backtesting

When selecting strategies, it is crucial to backtest AI-generated strategies before implementing them in live trading. It requires you to run the strategy on historical data to review its overall performance and loopholes. Additionally, you can get reliable and statistically valid suggestions instead of over-verification.

For instance, if you ask the AI tool to give you an AUD/USD scalping strategy, it will generate one for you based on moving averages and RSI signals. Once you backtest it against the historical market data, you will be able to measure its profitability, drawdowns, and the win rate.

This verification transforms AI insights into actionable trading systems by testing strategies and refining them before trading live.

Limitations of ChatGPT/LLMs in Trading

ChatGPT and LLMs offer valuable assistance, providing insights, analysis, and market predictions. Although they utilise historical data, their insights overlook real-time trading signals, such as volatility and emotional factors. That’s why you should avoid over-relying on these and use them to complement your analysis and enhance your practical trading.

Let’s look at an example of if you ask ChatGPT to generate a strategy. It will generate one. But you will notice that it will lack the nuance of sudden market changes. Simply put, it will lack the data regarding any real-time news that could have influenced the answer. That’s why you need to keep validating stuff side by side to ensure it’s authentic and accurate.

Avoiding Scams and Choosing the Right Broker

To succeed in forex, it is necessary to select the right broker to trade safely.

- Choose well-regulated brokers that are supervised by credible authorities.

- Avoid falling for unrealistic claims and unverified platforms before making a commitment.

- Read reviews and verify licensing status.

- Additionally, review the trading conditions to gain a comprehensive understanding of the overall environment.

Always remember, a regulated transparent broker operates based on:

- A fair system.

- Secure fund handling

- Reliable execution.

These are some of the main factors behind long-term success and growth in the forex market.

Regulation and Licensing Basics

For safe and efficient trading, always go for regulated and licensed brokers, as these ensure that all ethical and financial standards have been met. Some of the credible brokers include:

- FCA (UK)

- ASIC (Australia)

- CySEC (Cyprus)

- NFA/CFTC (US)

To learn how to identify a reliable broker:

- Look for segregated client funds.

- Transparent pricing

- Regular audits.

- Also, always check the broker’s license number on the regulator’s official website to ensure compliance and authenticity.

Common Forex Scams to Watch Out For

You might have come across guaranteed-profit schemes or unregulated signal services when browsing for firms. Beware, as these are common forex scams. Scammers typically promise risk-free trading accounts or huge profit promises to lure traders in. Avoid trading with unregulated brokers and social media apps. Always verify credentials and platforms before making a commitment. Never share your personal details without proper research for a safe trading experience.

Broker Comparison Checklist

To compare brokers, you should assess

- Regulation.

- Spreads and commissions.

- Deposit and withdrawal options.

- Customer support.

- Leverage limits.

- Trading instruments.

Always go for brokers that offer transparent pricing and provide protection against negative balances. Before committing, test their demo account to check their execution speed and platform performance.

Alternative to Brokers and Self-Capital

If you prefer not to trade with brokers, you can trade with reliable prop firms. Forex prop firms have revolutionised the financial markets, as they provide traders with funding and resources. In return, the firms take a designated percentage of the traders’ profit, mostly 70-90%. Firms require skilled traders who prove themselves to get funding. For instance, some of the top names in the industry include

So now, you can trade without risking your capital with top prop firms.

Community and Mentorship

With the right trading community and mentorship, you can enhance your trading experience up a notch. In a community, beginners get the opportunity to learn from others’ mistakes, discuss strategies together, and stay motivated.

Under a good mentor, you get the chance to refine your trading strategies, manage risk efficiently, and make educated decisions.

All prop firms offer educational courses and communities for their traders. For instance, if you are trading with The5ers, you can join their Discord community, which is built explicitly for their traders. There, peers share insights and knowledge and can engage in discussions with one another.

Additionally, The5ers Academy offers a forex trading course for its valued customer base, teaching how to trade forex. The course is up-to-date and is available 24/7.

Why Peer Learning Matters

Peer learning is crucial for beginners, as it helps traders grow by enabling them to collaborate and share problem-solving strategies. In such an environment, you can learn from various perspectives, gain a better understanding of market behaviour, and elevate your analytical skills to the next level. It also ensures focus and accountability. Moreover, it removes isolation during tough times and builds resilience, which is essential for success.

Online Communities vs. Paid Memberships

You can now be a part of free online communities, which include

- Discord

- TradingView

Free forums provide accessible knowledge for all. For advanced information and exclusive tools, you can also obtain paid memberships. When starting, free communities can be effective, but in the long run, consider paid programs. Always choose reputable and transparent platforms that have a proven track record of good performance.

Building Accountability into Your Learning

In forex, traders need accountability to grow and succeed in the long run. To foster it, you should consider:

- Setting clear objectives.

- Tracking your performance and patterns.

- Getting regular feedback from peers.

- Joining study groups or forums to stay focused and disciplined.

30-Day, 90-Day, and 180-Day Action Plans

In forex trading, having a structured guideline that plans clear goals and milestones helps beginners trade confidently and consistently. This ensures you grow through consistent practice and analysis, allowing for both practical and psychological development.

First 30 Days – Foundational and Demo Practice

First 30 Days – Foundational and Demo Practice

In the first 30 days, build a solid foundation.

- Start by learning about forex basics.

- Then, move on to practicing on demo accounts.

- Study patterns and charts, and stay up-to-date with market news.

Once familiar with the market system and trading tools, you will have the discipline and consistency required to survive the next stage.

90 Days – Journaling, Backtesting, and Strategy Refinement

From days 30 to 90, traders move from learning information to testing strategies.

- For refining the strategy, backtest the historical data.

- Journal your trade patterns, outcomes, and drawbacks.

- It is essential to refine strategies based on data like indicators, risk levels, and timeframes.

In this phase, you will learn about your strengths and weaknesses, and transition from basic to structured experiences that will prepare you for future trading.

180 Days – Consistency, Psychology, and Transition to Live

By Day 180, you will have developed a solid understanding of market structures, enabling you to achieve consistent and profitable results.

- The key is to review your performance.

- Focus on emotional regulation and avoid revenge trading or overleveraging.

- To test discipline in real-world conditions, start with a small trade using real capital.

By the end of this phase, you will be a confident and resilient trader who can survive the forever-changing forex market.

Downloadable Beginner’s Toolkit

The downloadable beginner’s toolkit is a forex tool that provides all essential resources in one place. From risk management to trade tracking, it helps beginners stay organised and data-driven. Each tool enhances your trading experience and increases your trading efficiency.

Trading Journal

With a trading journal, everything becomes simple to handle. Whether it’s an Excel or Notion template, both allow you to track your exit and entry points and outputs. By reviewing this data, beginners can measure their progress over time and stay accountable and up to date.

Risk Calculator

A risk calculator is used for position sizing and capital protection. To calculate your lot size, enter details like account balance, stop-loss distance, and risk percentage per trade. There are many risk calculators on the market. You can use

- Myfxbook

- DayTradersDiary

- FirstBuckFX Calculator

- BabyPips risk calculator

The risk calculator ensures you avoid impulsive decisions and manage losses effectively during trading.

MT4/MT5 Workspace Template

The MT4/MT5 workspace template offers traders a range of setups that include built-in indicators, charts, and essential analytical tools. This saves time and removes unnecessary clutter, supporting your efficiency. With custom layouts, you can improve focus and analysis, which is necessary for beginners developing a strategy routine.

Printable Forex Cheat Sheets

Traders use printable forex cheat sheets to obtain quick, visual summaries of core trading fundamentals, such as chart patterns and currency pair categories. These handy sheets are an ideal option for beginners, as they help you recall necessary information during live trading. With these, you can reduce mistakes and learn in a more engaging and structured way.

Conclusion

This complete step-by-step forex guide is everything a beginner needs to sustain and grow in the ever-changing forex markets. It covers everything from basics to tools for live trading. For sustainable long-term growth, it teaches beginners about trading psychology, theory basics, and practical experience in one place.

If traders follow a systematic approach, utilise essential tools, conduct thorough due diligence, and maintain connections with peers, they can achieve promising profits and long-term success. Remember, for sustainable growth, treat trading as a long-term skill instead of a shortcut to earn money.