A forex trader needs more than funding to succeed in trading, and that’s where a complete ecosystem of resources comes in. The forex market is multi-dimensional, influenced by global politics, economic events, and news events, for which the traders require different tools and learning resources. This underscores the importance of continuous learning and staying updated in the ever-evolving forex market.

They require a detailed approach that combines it all:

- Structured education

- Courses

- Books

- Communities

- Advanced tools

This diversity lets traders practice skills from multiple perspectives, such as technical, fundamental, and emotional, ensuring they adapt to the evolving market conditions. This practical approach prepares traders and instills confidence in their abilities.

Additionally, beginners interact with multiple platforms that build discipline, consistency, analytical depth, and context awareness. As a result, all information creates a cohesive and experience-driven foundation vital for long-term growth and success. This article helps you learn:

- Combining theory with practice.

- Practical tools to learn forex trading for beginners to enhance their skillset.

- Building a solid foundation for forex trading.

Structured Learning Platforms for Forex

Structured learning platforms have made forex learning easier for beginners. They provide a step-by-step, well-planned path from the basics, leading to the advanced level. These topics include pips, margin, leverage, and trading psychology. For example, BabyPips’s School of Pipsology provides a free, curriculum-style format.

These learning platforms allow traders a hands-on forex trading experience through guided exercises and quizzes, combining theory and practice. So, traders build competence and confidence hassle-free.

Online Forex Courses

To help traders enhance and grow in their trading journey, reputable institutions offer structured video and text-based courses for a guided learning path. For instance, Yale’s Financial Markets Course on Coursera can be a great choice.

The courses require traders to learn forex basics first, order execution, and risk control, followed by chart reading, pattern recognition, and strategy design. Additionally, some courses come with instructor feedback and downloadable resources. After completion, Udemy and Coursera give traders certificates as well.

Interactive Forex Learning Portals

Traders don’t stop at only learning concepts; they practice them through gamified lessons and quizzes. A good example is The5ers Academy, which interactively provides organized lessons to enhance learning for beginners.

These portals have gamified systems that feature activities like quizzes, scenario simulations, and progress bars to reinforce concepts. This allows traders to get practical experiences and retain concepts better. These platforms also offer regular feedback and track progress to enhance improvement. If you prefer visual and tailored educational experiences over passive learning, interactive learning portals match you.

Self-Paced Study Programs

Some traders prefer learning at their convenience, which is why many platforms offer self-paced study programs. BabyPips School of Pipsology could be the right option for you.

You can learn with flexibility that aligns with your schedule and comprehension speed. Some courses offer lifetime access and an adaptable structure that supports traders with packed schedules like studies and work. This adaptability empowers traders, giving them control over their learning journey. For instance, Investopedia offers lifetime access for its students, who can review the course whenever they find themselves in a fix.

This adaptability empowers traders, giving them control over their learning journey. For instance, Investopedia offers lifetime access for its students, who can review the course whenever they find themselves in a fix.

These programs are highly beneficial, as they combine reading materials, tutorial videos, and optional exercises in one place to promote clear, deep, and practical understanding.

Essential Reading for Forex Traders

Books are an evergreen source of knowledge for forex beginners about trading principles, mindset, and many other aspects. They go beyond online tutorials and offer structured knowledge about the market’s operation, trading psychology, and macroeconomics.

You can develop analytical and strategic thinking skills and improve emotional control with essential reading materials. Sometimes, combining books gives a better output. For example, you can combine these readings:

- Currency Trading for Dummies

- Trading in the Zone

In that case, you understand the mechanical and psychological tools required to survive the volatile forex landscape confidently and clearly. Let’s look at different types of forex books that could be helpful in your trading journey.

Forex Technical Analysis Books

In forex, traders deal with charts, patterns, and market behavior every day. For beginners, it could be challenging to operate these. That’s why traders need beginner-level technical analysis books.

Some of the highly valuable readings include:

- Japanese Candlestick Charting Techniques by Steve Nison

- Encyclopedia of Chart Patterns by Thomas No. Bulkowski

Technical books are an excellent option for reading charts, planning entry and exit points, and comprehending the market behavior, all through visual data.

Trading Psychology Books

To navigate the market, you must read mindset-focused books, helping with emotional regulation, greed, fear, impatience, and discipline. Some top essentials include:

- Mark Douglas’s Trading in the Zone

- Brett Steenbarger’s The Daily Trading Coach.

These teach consistency, confidence, thinking over emotions before reacting, and practical exercises for mastering mental resilience. With these psychology books, you can learn objectivity and stress management during volatile times to survive in the long run.

General Market Guides

Apart from these topic-focused guides, you can read broader finance and economics books to develop a solid market foundation. These books also offer an insight into the global forces driving currency movements.

For example, you can read The Intelligent Investor by Benjamin Graham and Principles for Navigating Big Debt Crises by Ray Dalio. These help with macro trends, investor behavior, and interest rate cycles.

Reading these general guides lets you smartly interpret news, central bank policies, and risk sentiments globally. Lastly, these help align fundamental and technical analysis to make educated decisions.

Communities & Discussion Forums

When trading forex, traders often need support and guidance to navigate their journey better. That’s where peer-to-peer communities and discussion forums come into play. They play a crucial role in providing knowledge, mentorship, and support to learners, fostering a sense of community and inclusion. This support helps traders thrive in their journey.

Traders discuss strategies, market trends, news, and more in discussion forums. For example, if you trade with The5ers, you can join their Discord community, learn from others’ experiences, and improve your strategies. Additional platforms include social media groups and WhatsApp groups.

These platforms help beginners develop confidence and a clear understanding of forex.

Forex Trading Forums

Beginners are new to forex and often need guidance with strategies, analysis, and market trends. That’s where online trading forums help traders interpret market sentiments, charts, and risk management. Best online forums for beginners include:

- Newbie Island by BabyPips

- Trading Systems by Forex Factory

In these forums, you can ask questions, share strategies, and get peer feedback and guidance. Additionally, these help broaden horizons and develop critical thinking skills.

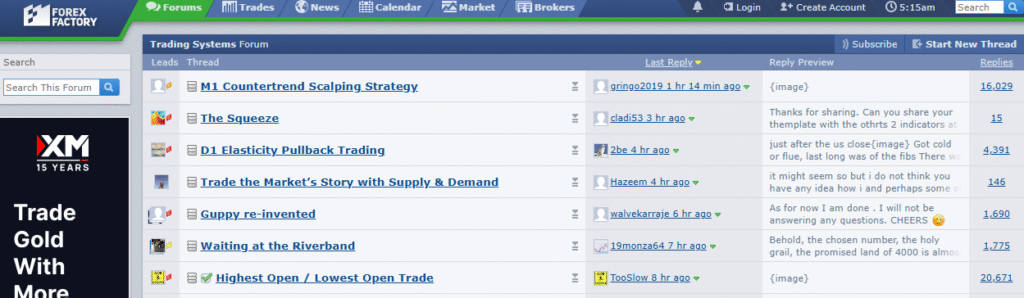

Social Media Forex Groups

Social media has made it easy for traders to communicate in real time with other traders through Facebook, Reddit, Discord, Telegram, and X (Twitter). These groups are really beneficial, as they give instant market updates and prompt responses to news events. These include:

- The5ers Facebook Group

- r/Forex on Reddit

You can join both to stay connected and be a part of discussions. However, always verify and double-check all updates and other insights since the social media environment is notorious for spreading misinformation.

Regional & Local Groups for Forex Trading

When trading from a specific location, traders can get great help if they join regional and local groups. These groups offer insights specific to each economic and cultural context. By joining these groups, you get info about:

- Local currency movements

- Active trading hours

- Regional restrictions

For instance, if you’re trading from London, join the London Forex meetup, which provides updated information about GBP pairs and Bank of England policies. Region-specific networks are essential for guided regional understanding and practical workshops for improving flexibility and adaptability towards different conditions.

News & Market Analysis Sources

In forex trading, time is one of the most critical factors. Forex traders need quick and timely access to all market news and updates that shape currency movements. Additionally, these sources help to make sense of all global events and their impact on exchange rate cut behavior. Professionals combine fundamental and technical analysis along with recent economic data before trading. You can use top-of-the-list platforms like:

- FXStreet

- Reuters

- Bloomberg

- Investing.com

With these sources, you can stay updated and get accurate news to make well-informed trading choices.

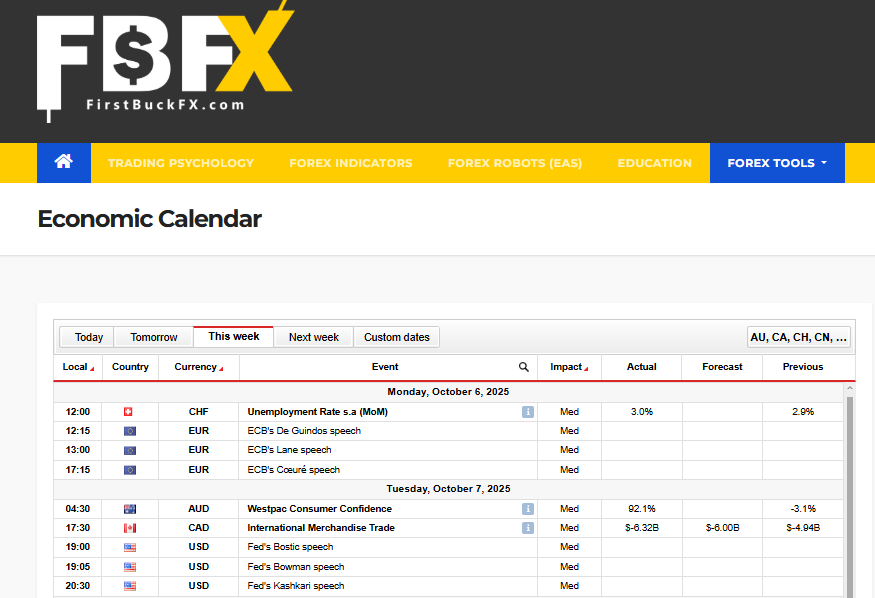

Forex Economic Calendars

In forex trading, traders anticipate volatility so they can adjust positions accordingly. For this, they need economic calendars, which list key events influencing the forex markets. They give updates about Fed rate cuts and CPI data releases, etc. The reliable sources include:

- Forex Factory

- Investing.com

- DailyFX

- FirstbuckFX

For instance, to get daily or weekly updates on key news events, you can visit Firstbuckfx and choose the currency pair you’re interested in. By selecting your preferred currency and your weekly or daily option, they list all the events of that timeframe. These updates are crucial, as they help decipher the role of fundamental data in shaping market sentiment and currency prices.

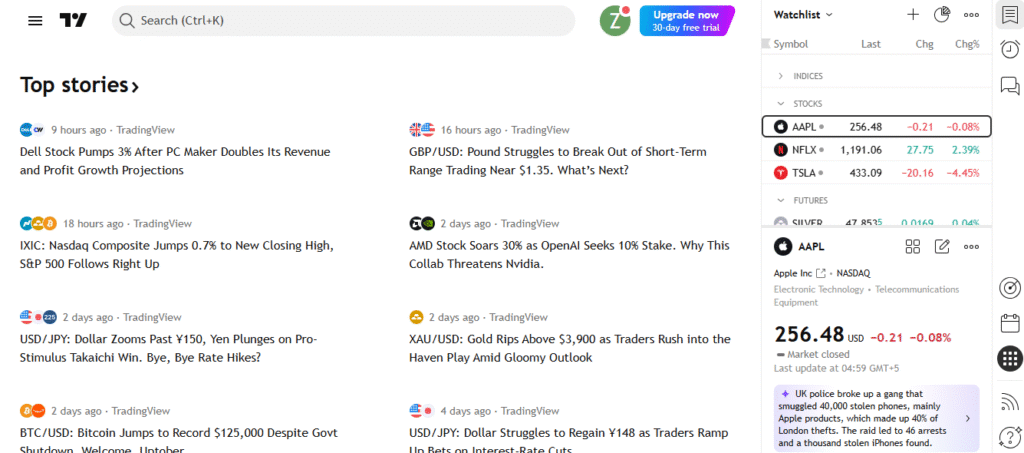

Real-Time News Platforms

In forex, traders need real-time news platforms to stay ahead of market moves. These platforms help you stay alert as the moves happen. You can join:

- Bloomberg Terminal

- Reuters Eikon

For free, reliable, and instant platforms, visit:

- TradingView News

- FXStreet Live feed

These platforms provide live updates about macroeconomic data, central bank policies, and other geopolitical issues. Keeping up with live updates is essential to make quick, timely, and risk-averse decisions. Additionally, these platforms develop the analytical discipline in beginners and help them react effectively to volatility.

Analyst Reports & Blogs

Beginners require actionable and straightforward ideas to sustain themselves in the forex market, instead of complex insights. Analyst reports and blogs take up the job of giving practical insights for traders. To get regular forex outlooks and macro forecasts explaining all currency trends, view ideal analyst reports like:

- J.P. Morgan

- Citibank

For simple strategies and market sentiment analysis, visit blogs like:

- DailyFX

- BabyPips

- The Forex Geek

Studying these interpretations gives you free education about market mechanics and potential opportunities.

Forex Video & Multimedia Learning

Some traders prefer learning from reading sources, while others prefer visual and multimedia learning. Visual learning makes everything easy, as it clearly illustrates theoretical forex topics. You can comprehend and perform better when you watch chart analysis, trade setups, or tutorials. These could be videos, podcasts, or webinars.

They help learners connect abstract ideas with live examples. As a result, you are guided every step of the way, and you can avoid unnecessary mistakes, improving your overall performance.

Forex YouTube Channels

On YouTube, beginners get free and systematic forex content such as video tutorials about concepts, strategy breakdowns, and even live trading streaming sessions. The go-to channels include:

- Bloomberg Markets & Finance

- No Nonsense Forex

You can find insights into technical setups and risk management on these channels. Additionally, you can learn how to analyze charts and perform under volatile market conditions.

Forex Podcasts

For forex traders, who multitask and need information and updates on the go, podcasts are their best bet. Podcasts offer insights from different sources, like analysts, economists, and seasoned traders, all in one place.

The participants typically discuss currency strategies and trends in a conversational tone. If you want real trading experiences and want to get better at psychological discipline, you can tune into the following programs:

- Chat With Traders

- The Forex Warrior

Podcasts are ideal for beginners, as they provide professional perspectives on risk and return and market behavior.

Forex Webinars

Due to webinars, traders can now directly interact with educators through live or recorded sessions. Whether they want to ask questions, see trade examples, or get a live chart analysis, webinars allow it all. Some reputable institutions like FXStreet hold frequent sessions for traders of all levels.

For instance, if you join a webinar, you can get quick answers to your queries, witness professional workflows, and enhance your knowledge about fundamental and technical analysis in a structured way.

Forex Practical Tools for Beginners

Forex trading goes beyond theory. The real test starts when traders have to apply what they learned in the live trading market. Traders use practical tools to bridge this gap and trade confidently.

These include simulators, trade journals, and analysis platforms. By analyzing, traders can learn when to make the right move, while journaling helps in pattern recognition. For instance, you can use:

- MetaTrader

- TradingView

- Myfxbook

These tools let beginners build their skill set by testing strategies, analyzing and tracking their performance, and learning improved decision-making.

Demo Trading Platforms

Before trading live, traders must trade in a demo account without financial risk. This helps traders backtest strategies and understand order execution and volatility. Not only do the traders practice their strategies, but they also learn psychological and risk management. Some of the best trading platforms are:

- MetaTrader 4

- MetaTrader 5

- cTrader

- NinjaTrader

- TradeStation

Another advantage of demo trading is a real-time data feed, which helps trade accurately. By the time beginners are done demo trading, they are prepared for real-world trading, with discipline, consistency, patience, and confidence.

Charting & Analysis Software

With charting and analysis tools, beginners can now learn to read charts, visualize price actions, use indicators, and identify trends. Traders can use some standard tools, such as:

- MetaTrader

- TradingView

- NinjaTrader

- E-Signal

- GoCharting

- BarChart

- YahooFinance

For instance, TradingView lets you see technical analysis, customizable indicators, and analysis of price movements. With these charting tools, traders can understand price movements better. They are great for beginners and help them learn how to interpret visual data and build solid strategies.

Trade Journals & Calculators

Most professional traders keep a trade journal and risk calculator to manage risk and build bright and healthy habits for long-term growth. When starting, beginners can significantly benefit from keeping these for tracking their progress, working through their strengths and weaknesses, and building accountability. The top trade journals include:

- Myfxbook

- TraderSync

- Edgewonk

These tools provide built-in performance tracking and analytics, which makes it even better for beginners. For calculating position sizing, risk-to-reward ratios, and money management, traders can use BabyPips of FirstbuckFX.

Both trade journals and calculators are essentials that ensure long-term profitability and stability.

Forex Backtesting Tools

Backtesting tools test strategies and their efficiency based on historical market data in a risk-free environment. Later, these strategies can be applied in the live market. It allows traders to examine the success rate of a strategy under different conditions. Some of the common backtesting tool choices are:

- Forex Tester

- MetaTrader’s Strategy Tester

- TradingView’s Bar Replay

- ThinkMarkets’s TradersGym

With this approach, traders examine the performance potential of different strategies in various conditions. Eventually, beginners become confident traders and perform better.

Conclusion

A complete forex learning ecosystem combines structured and systematic learning, involving reading, community interaction, news, multimedia analysis, and practical tools for a smooth trading experience. Each factor shapes a beginner’s foundation and provides a hands-on experience before entering the ever-long forex trading world.

Together, these build traders’ psychological, analytical, fundamental, and technical abilities. Lastly, traders get competent and disciplined enough to apply theory to actionable applications, fostering lasting growth and success.